Japan: Taking a Lead in Hydrogen

Japan has identified hydrogen as the answer to the energy problem, both for transportation and in power generation.

IF YOU think the energy situation in the UK looks challenging, just consider that of Japan. With double the population (126m vs 65m) crammed into brightly-lit, air-conditioned mega-cities, plus a vast manufacturing base to feed, total energy consumption is the world’s fifth largest. But Japan’s domestic natural resources (coal, oil, gas) are practically non-existent.

From the 1960s onwards, Japan bet large on nuclear, constructing over 50 reactors. Its first plant at Tokai was, in fact, supplied by Britain’s GEC. Then, in 2011, disaster struck as a massive tsunami overwhelmed the Fukushima Daiichi facility. With public confidence shattered, the entire atomic fleet was shut down. Whilst some plants are slowly returning to service following work to bolster their safety cases, energy-hungry Japan remains the world’s largest LNG importer and the third largest coal importer.

With a change of direction essential, Japan has identified hydrogen as the answer, both for transportation and in power generation. Via the 3E+S (Energy Security, Economic Efficiency, Environment + Safety) principles enshrined in its 2014 Strategic Energy Plan, Japan intends to showcase hydrogen at the 2020 Tokyo Olympics. Some 40,000 hydrogen fuel cell vehicles (FCVs) and 160 filling stations are to be ready for the Games, leading to 800,000 by 2030. As we’re about to see, Japan’s plans are certainly ambitious – and not without challenges.

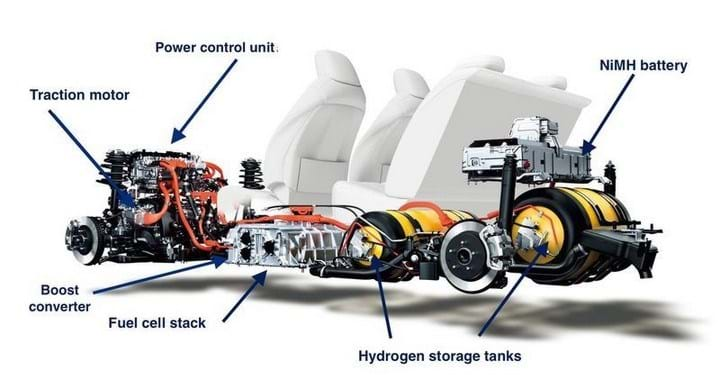

Japan’s massive car industry is getting on-board with its ‘big three’ (Toyota, Nissan, Honda) teaming up with Air Liquide to boost the national re-fuelling network. And, having pioneered the Prius petrol-hybrid in the 90s, Toyota recently launched the Mirai (see Figures 1 and 2), the world’s first purpose-built hydrogen fuel cell vehicle. Its hydrogen-fed fuel cell can even power homes, potentially a life-saver in an earthquake-prone nation.

Fuel cell vs electric

But whilst economies-of-scale might address the Mirai’s £60,000 price-tag, some warn of Japan creating unique ‘Galapagos’ solutions which cannot readily be marketed globally. By constrast, North America is pursuing more of an ‘electrify everything’ philosophy as exemplified by Elon Musk. Tesla’s billionaire founder has slammed fuel cell vehicles as “really dumb”, betting instead on an electric vehicle (EV) and domestic battery storage combination. And with limited take-up of ‘hydrogen highways’ to date, Europe also broadly favours the electrical route for transportation.

The fuel cell vs electric argument is not clear-cut, however. Electric vehicle proponents note that using renewables-sourced electricity to directly charge up a battery-electric vehicle is much more efficient (73%) than using the same power to generate hydrogen to feed a fuel cell vehicle (22%). Others counter that this may not provide the full picture: hydrogen could be produced from surplus ‘green’ power generated at effectively zero marginal cost. And that electricity distribution infrastructure (designed around relatively low mean demand) may struggle as electric vehicle charging demand ramps up. According to a German study, the overall cost of switching 20m vehicles to fuel cells would be cheaper than for electric vehicles. The study goes on to show, as we’ll see below, that these two so-called rivals might instead complement each other with fuel cell vehicles used by larger, centralised users, and electric vehicles preferred by private motorists.

Storage and transport

Storing and transporting hydrogen is not without its challenges.

To prevent leakage and to ensure crash safety, automotive engineers have equipped the Mirai with a sophisticated 90 kg carbon-fibre fuel tank to contain the 5 kg of hydrogen needed to provide a 482 km driving range. Meanwhile, chemical engineers have been busily addressing hydrogen challenges on a larger scale.

Building on its 30-year track record in LNG, Kawasaki is promoting liquefied hydrogen solutions for bulk shipping. And it's using its experience gained in storing the liquid hydrogen used in Japan’s space programme to develop the national storage network. To maintain the required temperature of -253 ºC, highly effective insulation is key: the tank is double-hulled with perlite (a thermal insulation material) between the inner and outer walls.

Elsewhere, Chiyoda’s SPERA concept proposes organic chemical hydride (OCH) technology. By combining hydrogen with toluene to form methylcyclohexane (MCH), it can be transported long-distance by ship as a liquid at ambient conditions. Upon arrival, the process is reversed, releasing the hydrogen with the toluene recycled.

Such liquid organic hydrogen carriers (LOHCs) require complex synthesis and regeneration processes, however: Germany’s Siemens instead proposes to convert hydrogen into ammonia for ease of storage and transportation before using it directly as a fuel for power generation and transport.

Sourcing hydrogen

Returning to Japan, the issue of where to source hydrogen is also proving contentious. Last year, The Chemical Engineer reported that Kawasaki Heavy Industries and the Australian Government entered into a pilot-plant partnership to begin converting Australia's Latrobe Valley’s vast lignite reserves. Whilst a scaled-up development would include carbon capture and storage (CCS), environmentalists have lambasted it as yet another coal-based development. Furthermore, they note that upon arrival in Japan, the hydrogen could be bled into the supply to existing thermal power stations, thus prolonging the nation’s dependence on imported fossil fuels.

That said, with storage and distribution infrastructure established, alternative hydrogen sources, including local renewables, could follow. Plans are already underway in the Fukushima prefecture to construct an 11.3 MWe solar-powered plant to generate hydrogen via electrolysis. But just to prove there are no perfect solutions, elsewhere in densely-packed Japan, concerns have been raised about the destruction of forests to make room for solar farms. Meanwhile, developments in floating offshore wind and tidal energy could prove key in the deep and stormy waters surrounding Japan.

What lessons can be learned?

So, what might the UK learn from Japan’s early lead in hydrogen? Whilst technology learnings are always there to be shared, the deployment may be very different. In the UK, the renewables sector is well-established and growing further; some of this green electricity could be converted into green hydrogen. This could then be used in power generation to smooth out the intermittent output from offshore wind.

Or it might be used a substitute for (or a diluent to) natural gas for our heating needs as per the H21 concept. By contrast, the typical Japanese home lacks central heating (at least as we understand it). And with parts of the UK North Sea oil & gas sector approaching decommissioning, redundant offshore infrastructure could be re-purposed for hydrogen production and storage.

And in transportation, we might see hydrogen best deployed as a substitute for large-scale diesel users: imagine the improvement in urban air quality of switching commuter trains, buses, delivery vans and taxis over to hydrogen. And as those major users can be re-fuelled from centralised hubs, the need for widespread new infrastructure can be much reduced, especially if the UK public plumps for EVs for its personal transport.

There’s no doubting the scale of Japan’s hydrogen vision and its determination to deliver on it. And whilst much of this makes sense in the context of the nation’s unique energy challenges, the hydrogen roll-out won’t be quick or cheap. Few other places may choose to embrace hydrogen as widely but there are sure to be valuable lessons to be learned from the Japanese.

This is the third article in a series discussing the challenges and opportunities of the hydrogen economy, developed in partnership with IChemE's Clean Energy Special Interest Group. For more entries visit the series hub.

Recent Editions

Catch up on the latest news, views and jobs from The Chemical Engineer. Below are the four latest issues. View a wider selection of the archive from within the Magazine section of this site.