Engineering Net Zero Part 4: Giving Industry and Transport Operators a Choice

David Simmonds brings his analysis closer to home, asking engineers to collaborate and create options for heavy duty energy users

IN THE second and third features of this series I looked at how we could provide domestic consumers choice, so I would like to extend this theme to industry and, briefly, the heavy transport sector. Government targets for these two sectors are to be realised later in the quest for net zero.

Like domestic consumers, most businesses and heavy transport operators rely heavily on oil and the public utilities (natural gas and electricity), and they have developed their energy inputs around their availability, cost, and flexibility. Businesses were particularly affected by energy price hikes resulting from the Ukraine war, and changes within the utility sector and the demand to achieve net zero goals are requiring all businesses to radically relook at their energy mix and processes. While the power sector has taken the lead in terms of alternative energy supplies, industry is leading on decarbonising use, but it still needs clear government policy and support. There are opportunities as well as challenges, and engineers working in the sector will be at the heart of their decarbonisation. However, we need to maximise the options available in the "engineer’s toolkit", so that they deliver optimal solutions. Industry, and our economy as a whole, has prospered as a result of alternative energy vectors, and we must ensure we retain optionality and choice – again no one size fits all.

Energy usage

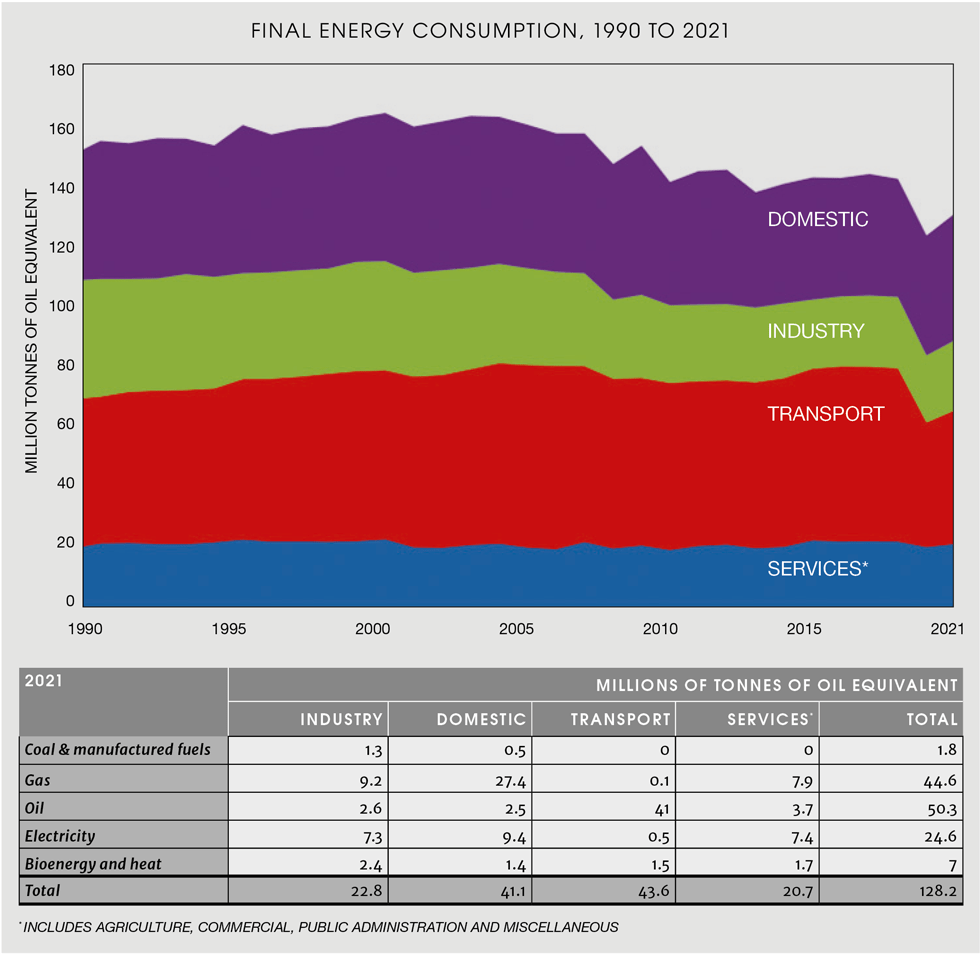

The figure below, extracted from the Department for Business, Energy & Industrial Strategy’s UK Energy in Brief 2022 (p10), provides an overview of the UK’s total energy demand, dominated by that gas, oil, and electricity usage

Industrial demand has dropped over the years due to efficiency improvements and declines in manufacturing capacity as we outsource goods. Compared to other sectors, industry utilises a wider spread of energy vectors, though, proportionally, its highest demands are for gas and electricity.

In contrast, transport is almost totally dependent upon oil, and demand has increased. However, two-thirds of that total is for domestic transport already discussed in a prior feature.

Both sectors are viewed as hard to shift and as a result, savings are expected to mainly accrue in the second half of the UK government’s plan for net zero 2050.

Government focus on green technologies for industrial hubs

Looking first at industry, manufacturing has primarily developed around major industrial centres. This presents the first opportunity, for initiatives can look at the decarbonisation of multiple manufacturing businesses within a given area; the UK government has termed these “clusters”. Today, these clusters are heavily dependent upon unabated fossil fuels for their energy intensive activities, such as refining, steel, cement, and glass.

Back in 2021 the government announced a package to promote green technologies and jobs. This was further developed as part of its clean growth strategy, which included a number of “grand challenges”. One of these missions was to “Establish the world’s first net-zero carbon industrial cluster by 2040 and 4 low-carbon clusters by 2030”. This would be achieved by reducing emissions and installing the low-carbon infrastructure. It went on to say that this will attract new investment and innovation, positioning the UK’s clusters as top areas for global inward investment, driving demand for low carbon products and technologies by harnessing the power of markets, the public sector, universities, and local communities.

In March 2023, The Grand Challenge Missions policy paper was withdrawn and replaced by the earlier Build Back Better: our plan for growth, and the UK Research and Innovation (UKRI) Challenge Fund, which was established back in 2019. The latter supports, among many others, the Industrial Decarbonisation Challenge (IDC). This was launched with £210m (US$266m) of government funding, matched by £261m from industry, to invest in developing technologies including carbon capture and hydrogen fuel switching. These technologies will be deployed and scaled up within the UK’s six largest industrial clusters. It went on to state that, together, the IDC and its industrial partners will lay the foundation for developing at least one low-carbon industrial cluster by 2030 and the world’s first net zero industrial cluster by 2040.

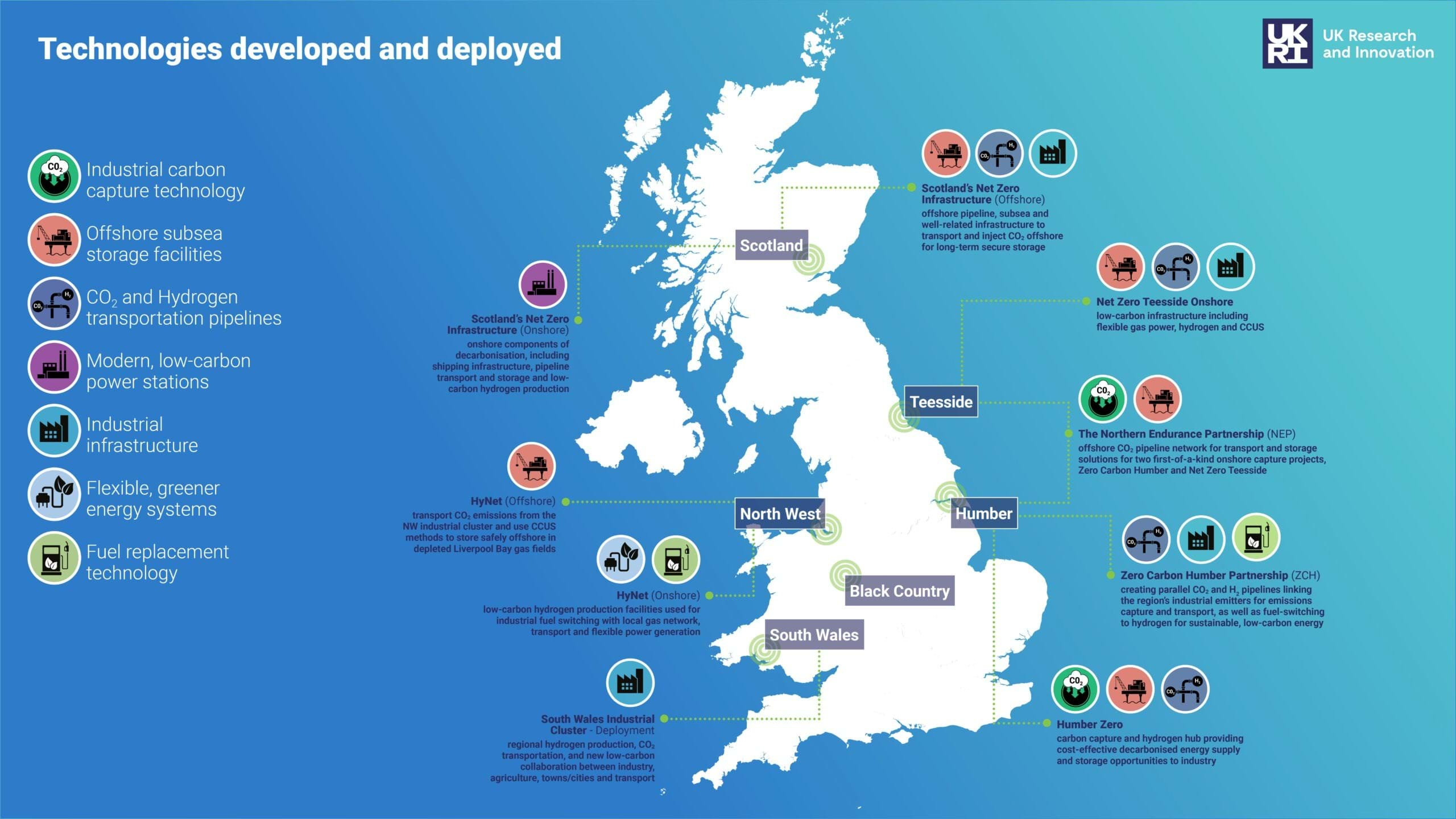

Fortunately, the UK government still have decarbonisation of the sector in their sights. However, the short-term ambitions do seem to have been watered down, partly as a result of the country’s financial predicament. The six clusters selected – Scotland, Teesside, Humber, North-West, the Black Country, and South Wales – are shown on the map above produced by UKRI. As can be seen from the chart, there were a range of technologies and industries being considered at each site. A further cluster is being considered around the Solent, with over 80 signed-up partners.

Two of the six clusters (HyNet and the East Coast), were prioritised as "Track-1" in November 2021 for delivery in the mid-2020s, with the Scottish cluster noted as a reserve. The remaining "Track-2" clusters were still prioritised for operation by 2030. At the same time the government allocated up to £20bn for carbon capture and storage (CCS) projects. The East Coast Cluster along with the future Humber Cluster will utilise the Northern Endurance Partnership’s saline aquifer formation for CO2 storage, while HyNet will utilise the depleted Hamilton gas field in Morecambe Bay. At the end of last year, the government presented updated business models for both hydrogen and CCS, and generally these have been well received, but incentives introduced in the US via the Inflation Reduction Act, or in the EU via the European Green Deal, currently trump what is on offer here – just look at the US plans for their Gulf Coast which include hydrogen exports.

The East Coast Cluster will utilise the Northern Endurance Partnership’s offshore facility at what was the Goldeneye field, while HyNet will make use of one of the old Morecambe Bay reservoirs. At the end of 2022, government presented business models for hydrogen, carbon capture and storage, and generally these have been well received, but the competitive position of the UK compared to incentives introduced in the US (the Inflation Reduction Act) or in the EU (the European Green Deal) currently trump what is on offer in the UK.

In March, eight “industrial” projects within the two Track-1 clusters were selected, representing a range of innovative carbon capture and hydrogen use technologies.

East Coast cluster:

HyNet cluster:

- Hanson Padeswood Cement Works Carbon Capture and Storage Project

- Viridor Runcorn Industrial CCS

- Protos Energy Recovery Facility

- Buxton Lime Net Zero

- HyNet Hydrogen Production Plant 1 (HPP1)

There are some groundbreaking projects here, and a wide range of further projects are planned as these clusters proceed with their implementation plans. A few weeks ago, the prime minister, Rishi Sunak, annouced that the Humber and Scottish clusters will also proceed, the latter using the Goldeneye field for CO2 storage. In addition, a further CCS has been given Track-2 approval, at the depleted Viking Field offshore the Humber. Harbour Energy and BP are looking for this development to store CO2 recovered from the Humber and other UK sites shipped via the port of Immingham.

Through Innovate UK, the government has also initiated a competition for smaller dispersed clusters, located outside of the major hubs, where they can submit proposals for decarbonisation study funding. This is currently supported by a £5m studies budget, with the selection of proposals expected in early Q3 for studies to be completed during 2024.

In its latest review on progress to net zero, the UK Climate Change Committee (CCC) recognised the government’s efforts with industry but noted a number of policy deficiencies, including the lack of strategy to support direct electrification, the need for more support beyond the current Track-1 and Track-2 clusters and dispersed cluster scheme, and for industrial programmes to further improve energy use efficiencies.

Responding to the report with respect to industry, the Institution of Gas Engineers & Managers’ CEO, Oliver Lancaster, said we need to “get on with low-regret electricity and hydrogen infrastructure investments that can proceed now – with activity around industrial clusters being candidate locations”. However, he warned “current funding competitions are stalling potential for quicker progress (through) lengthy red tape and budget barriers”.

In short, we have an embryonic plan for industry, but it needs concerted action to both develop and realise it.

Re-engineering industry

Clearly our engineering community has a key role to play to deliver decarbonisation in this sector, and engineers are leading in much of the work on the Track-1 and 2 clusters and the offshore carbon dioxide disposal sites. Building on UKCCC and IGEM’s comments I would like to offer the following additional observations and suggestions for engineers and policymakers to consider:

- The CCC’s quest for electrification of industry should be welcomed, but the demand for clean power is already increasing as a result of electrification of the transport and buildings. Like domestic consumers, industry sees the spark-gap impact on their electricity pricing. Uncertainties over future energy pricing, such as the relative pricing of electricity and hydrogen (subject of a later feature) will certainly play into investment decision-making. Like consumers, businesses should be given a choice of energy vectors and some certainty (protection) over future pricing so that they can select the optimum technologies to fit their needs and economics

- Industrial clusters provide opportunities for rapid scaleup of hydrogen and power networks which can, locally, also help meet increased demand from transport, buildings and other sectors. Synergies between sectors, including agriculture and other transport (see below), will help speed up decarbonisation more widely. In a future feature on resources, I will also stress the need to manage priorities for land use; decarbonisation will reduce pollution, which in turn will provide more opportunities for sustainable development in and around the clusters. I strongly believe engineers should be looking for synergies and assist with local land allocation planning. In particular, I would like to stress the need for a broader sustainability agenda when delivering these major cluster projects, something I addressed in another TCE article four years ago

- I listened to the Innovate UK briefing event in early June, launching the dispersed cluster scheme. The CCC welcomed this initiative, but thought the funding was light. Listening to the quality of the discussion at the webinar, I would go further to comment that, while some technical support will be provided during the execution of the selected studies, more engineering support and guidance is needed to ensure groups submit quality proposals for studies.

Net zero heavy transport

Heavy transport is a broad category encompassing trucks and buses, shipping, aviation, rail, and heavy mechanical machinery, all of which, today, are almost universally powered by oil. It is viewed as a hard to budge sector, and certainly needs a number of innovative engineering solutions to decarbonise. To do it justice, heavy transport probably deserves its own feature, but I have already briefly covered heavy road transport in an earlier feature, so I will limit my discussion here to shipping, aviation, and the railways. This will continue the theme of providing operators with choice and, where relevant, highlight possible synergies to other net zero initiatives.

Shipping

Shipping contributes 3% of worldwide emissions and is already seeing some change with the development of ships powered by liquefied natural gas (LNG). This is reducing both CO2 and sulphur emissions, typical from traditional bunker fuel. But, as another fossil fuel, LNG must be viewed as a transitional technology. Very recently, the International Maritime Organization (IMO) reached an agreement among member states to commit to net zero by, or around, 2050. The IMO vision, for as yet it does not have a plan, is to use wind power, hydrogen and/or ammonia, and green methanol. Some electrification, with batteries, is also possible for ferries and other vessels routinely travelling short distances.

Experience with LNG will enable shipping to more easily adapt to tomorrow’s hydrogen or ammonia. We may laugh about wind power, but remember, that is what we used to rely on. Automation, with associated reductions in crewing, improved boat designs and weather forecasting will all reduce future shipping costs and increase the potential for wind-based solutions. The sector cannot just look at ships, as it also relies on supporting infrastructure at ports, and here we can see real synergy as many major ports are located close to, or are part of, those industrial clusters.

Aviation

This sector contributes slightly less emissions than shipping (2.5%), but despite efficiency improvements, the demand for air travel has seen aviation’s net share of global emissions increase year on year. Due to other pollutants its actual contribution to global warming is 3.5%. Aviation’s equivalent of IMO, IATA has also committed to a net zero 2050 target.

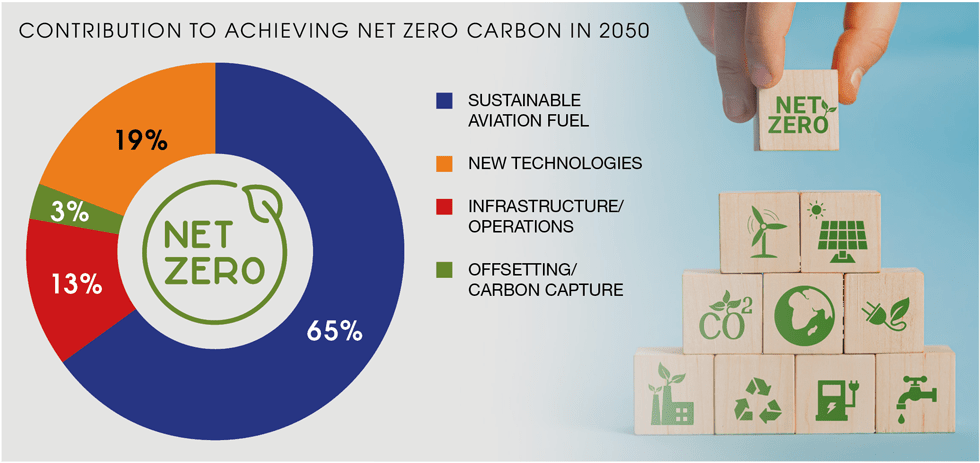

Achieving this is going to be incredibly difficult, but they have made some steps to quantify their plan. The above figures from their factsheet emphasise the long-term reliance on sustainable aviation fuel. This will be a combination of synthetic fuels, produced from hydrogen, and biofuels. Technologies for both are well established and will ensure continuity of today’s aircraft fleet. Like other net zero challenges, the determining factor will be scale-up of supply of those fuels, and in my view, most biofuel production should be prioritised to this sector.

Hydrogen jet and fuel cell planes are being considered and tested, but these will require significant testing and certification. The fuel cell option deserves to be the priority technology as this would reduce that ancillary pollution, though, for short-haul flights, all electric options are also being tested. The important thing is that there should be a range of options, and all need to be pursued at pace to deliver a tested portfolio for airline operators to choose from to meet their varied short-, mid- and long-haul flight needs.

Railways

The railways have long been seen as the Cinderella transport sector. Despite a recent announcement by DB freight to ditch their electric locomotives on cost grounds (again due to that spark gap), going forward, they still have the potential to offer an environmentally friendly and flexible alternative to road transport. The sector has made great strides in electrification, starting way back in early twentieth century with London’s underground. This has continued through to today when most mainline routes have been electrified, the Great Western Railway being one of the more recent conversions.

Our moves towards a high-speed rail network have been fated. The Channel Tunnel service to Europe took much longer to realise than planned, while HS2 is currently seen as a failing project. Mega-projects of this nature have their own, very significant, carbon emissions, made worse if they are abandoned. While engineers are responsible for the development of options, others need to fully assess environmental, planning, and social considerations. I for one, believe much of these high-speed routes should be developed as tunnels, as practiced on the Continent with recent examples in Switzerland and Austria to Italy; execution risks can be better managed, and projects with lower social and environmental risk can be delivered more quickly.

Returning to our current network, there are many local services where electrification, with or without batteries, is currently uneconomic. Here train operators are looking to hydrogen trains. Again, these could be internal combustion engines or fuel cells, but fuel cells offer the "cleaner" solution, and latest designs now a consider a fuel cell hybrid which can operate directly on electrified track but utilise hydrogen when operating on longer unelectrified sections. As for hybrid cars and vans considered in my earlier feature, this maximises both efficiency and flexibility, and the technology is being considered for use in the US. Germany has been testing hydrogen trains but, with shorter unelectrified lines, it is less likely that they will be deployed there. Looking for synergies, our decarbonised industrial clusters, with green power and hydrogen, can energise our railways, particularly in Scotland.

Again, we must better integrate our railways into our cities. Delays to HS2’s arrival into Euston epitomises the issue, but why are Eurostar services more expensive than their flying equivalent? Part of the answer is the lack of planning and investment in train terminals, which would allow more frequent services with faster turnarounds. Madrid is tackling this problem by building their high-speed terminal, at Atocha, underground.

Businesses delivering net zero

Often the sheer size and scale of enterprises has meant that these sectors have self-provided their energy. A good example is the London Underground when, back in the early 1900s, the owners built their own power station as part of their electrification, which in turn "cleaned-up" and improved reliability of passenger services. Today the network is responding to climate change through a number of innovative approaches. Other examples of self-support include the iron and steel industry which, from the mid-19th century, developed on the back of UK’s considerable coal resources, and, in the mid-20th century, oil refineries which utilised their own oil resources to power their businesses.

Over the years, businesses have sought integration and so the Cluster decarbonisation model should succeed. Businesses are embracing new technologies to deliver net zero, but it is interesting to see that 104 UK companies have written to the Rishi Sunak concerned over government starting to lag on its commitments. However, as noted in my first feature on communication, public support for net zero is also waning especially when it hits their pocket, and more generally they are not trusting of Big Business. Comments posted on The Times article about that letter to the PM, were predominantly negative towards both net zero and business. A few weeks later in the same paper Professor Helen Thompson went on to analyse Why net zero requires a reinvention of civilisation, by looking at ammonia, cement, plastics and steel, all fundamental to our economy. The challenge for industry to move away from fossil fuels is immense, and a recent review by Bain & Co notes that many companies are anticipating that they will no longer meet their 2030 decarbonisation targets.

Joshua B Freeman in Behemoth: A History of the Factory and Making of the Modern World sets the scene for his book by explaining how we all live in a factory-made world, but most of us pay little attention to the industrial facilities upon which we dearly depend. He presents a fascinating history of how we created giant factories and industries but concludes that the most important lesson they provide in that it is possible to reinvent the world, it has been done before, and it can be done again. The goals of the US Gulf Coast programme and here our Track-1 Cluster projects offer hope for that reinvention.

Both industry and transport operators are keen to play their part, and, in the main, they can achieve their net zero with established technology, though at some cost. The best way to mitigate that cost comes through certainty on future pricing, and a rapid scaling up, such as we have witnessed with the deployment of renewables. The US and EU administrations have seen the light here, by offering guarantees on short-term costs through both subsidies and a strategy which still recognise today’s dependence on fossil fuels. Even China, with its more planned economy, is fast forwarding its net zero plans through rapid scale-up of wind, solar and EV manufacture. Yes, many criticise China for its current emissions, but, as we will see in my next feature, it is the powerhouse behind much of our renewable energy technology.

The other cost mitigation, noted in this and prior Engineering Net Zero features, is the need for improved collaboration. The case for industries collaborating within their cluster is clear but the benefits can be exponential when we extend this collaboration across clusters and sectors.

There is also concern over the level of debt some companies carry; most recently this has been a point of debate for the water sector. If that debt is just financial engineering, then we should all worry, but debt to fund a transition to real change, lowering long-term costs or opening new markets, should be viewed favourably. Personally, I have overseen development of successful mega-projects which depended almost entirely on debt over equity. This approach should be considered by both businesses and governments, the latter through borrowing for subsidies, as they pursue their net zero mega-projects such as power grid expansion or gas grid conversion. However, in all cases, this must be supported by robust plans and business cases. We can close the circle here by governments assisting businesses. To maximise that assistance, it is imperative that government, through its subsidies and pricing of alternative green energy vectors, opens up technological choice.

Frankly, although these sectors are expected to deliver during the later stages of the "plan" to deliver net zero, I feel that government thinking is more circumspect and realisable than that for the consumer-facing sectors of transport and heating. The engineering community can embrace these opportunities, developing the wider story of how they can be delivered for the benefit of everyone, particularly for their local communities. Many of us work for the 104 companies who wrote to the PM, so we must get our voices heard, communicating both the case and plan for change. Further, we need to collaborate between businesses and across sectors and expand that toolkit. IChemE should continue to play a pivotal role, shining a light on how the profession is addressing some of the biggest challenges in our society today and assisting with the establishment of policy and standards, such as those needed for our future hydrogen economy.

This may have been a high-level review, but I don’t apologise, for we need simple, but convincing, communication.

Recent Editions

Catch up on the latest news, views and jobs from The Chemical Engineer. Below are the four latest issues. View a wider selection of the archive from within the Magazine section of this site.