Engineering Net Zero Part 5: Consuming the Planet's Resources

David Simmonds explores the picnic basket of our energy transition, our increasing dependency on China, and how hydrogen can help us deliver an electrified economy

AS I STRESSED in my first feature on communicating a plan, the public need more confidence that the policy decisions underpinning net zero can be sustainably resourced. The sheer scale of our energy transition means that, whatever we do with new technologies, we will need significant quantities of minerals to realise them.

Understandably, many questions are being raised over the viability of our transition. A number of energy transition measures compete for “space”, be it land for solar and wind farms, for reforestation or bio-crops, or sea acreage for wind farms or tidal power schemes. Fresh water needed for hydrogen production is also a scarce resource as we provide for the growing population, affected by both drought and flood. We also need to consider the resources currently utilised so that we do not unilaterally dispense with these before we understand how they too can contribute to our sustainable future.

Engineers will play a key role quantifying what resources we need for the transition, and, as shown here, communicating the challenges and opportunities they provide to secure a sustainable future. Although not stated publicly, it is likely that resource constraints were a factor behind UK prime minister Rishi Sunak’s recent decision to defer policy targets for an electrified net zero.

Fossil fuels

Briefly, I should start with fossil fuels, for their availability has long been cited as the constraint to the economic viability of the planet. Fossil fuels are finite, and they will run out, but the engineering community can be proud to have consistently replenished the fossil fuel "creaming curve". The climate crisis is a result of that success, and today’s challenge comes not through the lack of fossil fuels, but from their impact.

The creaming curve successes are being extrapolated to the new commodities required for our transition, but there are less favourable fossil fuel analogies. Here in the UK, we saw significant economic downturn in mining areas when we turned away from coal. Russia’s war with Ukraine has shown how we have become dependent upon resources from politically unstable countries, while extraction techniques can have direct environmental and social consequences, such as experienced in Texas at the turn of the 20th century or later in Nigeria.

From my personal experience, another learning is the challenge of the commodity supply chain. BG Group’s strapline was "resources to markets"; we considered the complete chain, from exploration, through production, transmission, and distribution, to consumer markets. In my early career with Shell and its first liquefied natural gas (LNG) projects in Borneo, we again had to secure the gas chain. These 20+ year developments were backed by sales contracts signed with Japan to protect the massive investments in Borneo. Oil has always been a commodity, but gas was only truly commoditised once LNG started to be freely traded in the early 2000s. As we will see, we need to extrapolate these supply chain learnings to future energy vectors.

Still, almost 80% of our current energy comes from fossil fuels, and many activists call for a turning off of the tap. However, policymakers are well aware of the impact this would have on our lifestyles, so engineers must assess how we can phase out fossil fuels and reduce energy demand. I described in my last feature on industry and heavy transport how both carbon capture and blue hydrogen can help us transition from fossil fuels.

Minerals and speciality metals

The recent BBC radio coverage of Ed Conway’s book Material World provided many thought-provoking insights into materials needed for today’s and tomorrow’s world. I won’t spend time addressing steel and cement, but these are critical for the transition, be it for wind farms and nuclear, battery gigafactories or new electrified transport infrastructure such as HS2, and we must dramatically reduce the carbon footprint of these commodities and such projects.

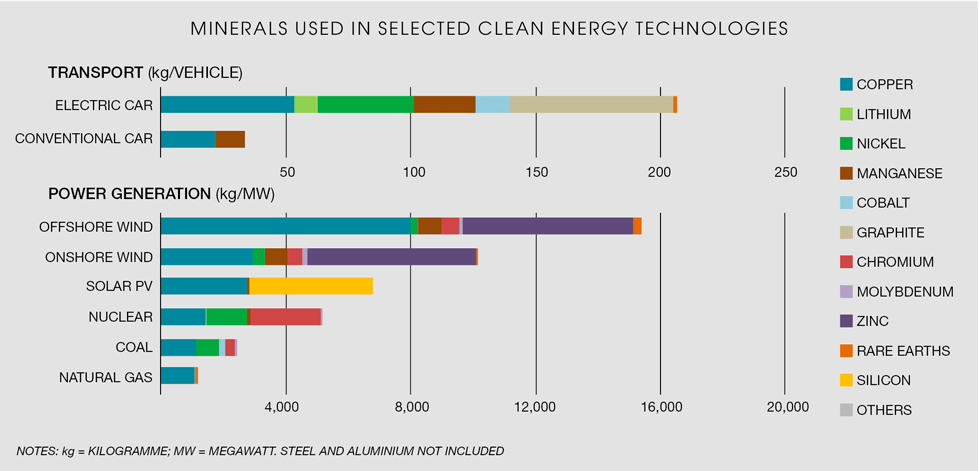

My focus here is on speciality metals, essential for many transition technologies, including batteries, solar panels, fuel cells, wind turbines, and electrolysis units. IEA’s excellent critical materials report provides a clear picture of the scale and challenges involved, exemplified by three charts extracted from its executive summary. This first chart shows how we will become more dependent on these minerals.

IEA have confirmed that the data for power generation is based upon “installed or nameplate capacity”. When one considers intermittency of some technologies (resource availability factors for offshore wind are typically +/-45%, onshore wind +/-35%, and solar +/-15%, while nuclear is +/-95% and 90% for baseload coal and natural gas), the comparison is starker.

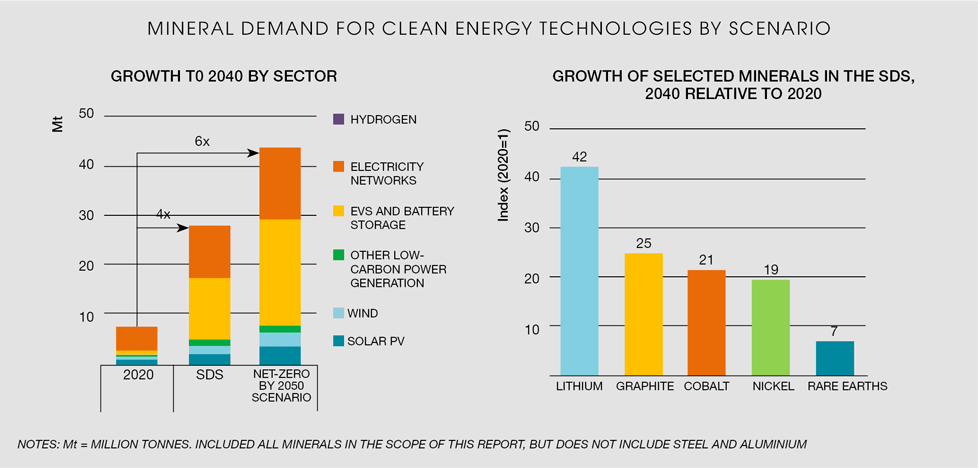

This next chart considers the extraordinary growth needed to meet IEA’s net zero scenarios.

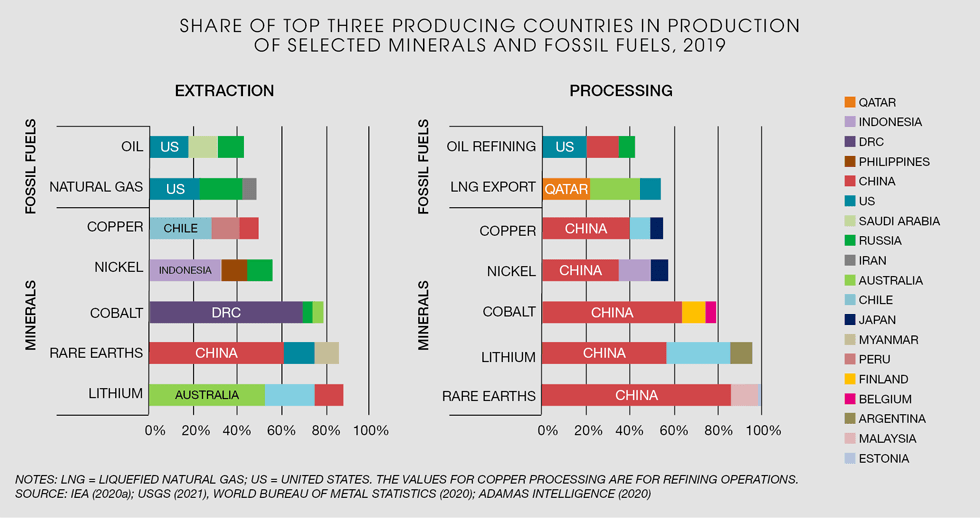

The third chart shows that, while extraction is global, we are heavily dependent upon China for the mineral processing.

Rare earths

The most precious minerals are the 17 rare earth and six platinum group metals which, typically, are used to modify the performance of other materials or metals – they are the vitamins of the energy transition. As surface modifiers for electrolyser anodes, demand for platinum and iridium will grow, while platinum, palladium, and ruthenium, a hardening agent, are required for production of fuel cells. In another report, McKinsey highlights our dependence on China for neodymium and praseodymium for wind turbines and electric vehicles (EVs).

Growth rates for platinum are forecast to be close to 10%, year on year, to at least 2030, by when we should see more recycling of catalytic converters from scrapped internal combustion engine (ICE) vehicles. Further, research into speciality coatings is expected to lead to lower cost alternatives while increasing the efficiency of electrolysers and fuel cells.

Lithium

Lithium is the critical resource for batteries, the enabler for new transport and energy storage. As we see from the second chart above, IEA forecasts its demand to grow 20%, year on year, outstripping other minerals. Most of today’s batteries are Li-ion, with lithium and cobalt or manganese cathodes. A longer life and lower fire risk alternative is a lithium iron phosphate (LFP) battery, though these have lower energy density. Toyota is trialling solid state batteries which should offer higher charge capacities and eliminate fire risk, but, with lithium anodes, they require up to 35% more lithium. To promote these technologies, Toyota is benefiting from the recent US Inflation Reduction Act (IRA) by establishing a battery research laboratory in Michigan.

Lithium is a cream-coloured light metal, and so could be viewed as the cream of the transition. It is recovered from mineral deposits, such as spodumene in Australia and the US, with typical ore concentrations of 6%, or from brine liquors, recovered from South American deserts, with concentrations between 200 and 1400 mg/l. Extracting lithium from the ore involves crushing and chemical treatment, while brine extraction, with its lower concentration, involves evaporation. The latter is accomplished in large ponds and often takes up to a year. China is starting to test recovery from seawater, which typically contains 0.2ppm lithium, using electrochemical processes. The fastest growing segment is mining, as it is easier to scale up and avoids that slow evaporation process, with its challenging working conditions: indeed the Columbia Climate School calls up the lithium paradox.

The concentrated liquors or ore are shipped to processing centres for production of lithium carbonate or hydroxide. In turn, this is transported to so-called gigafactories for the manufacture of battery banks. China dominates this energy intensive processing, burning fossil fuels.

Recognising the Chinese stranglehold, Tesla is embarking on a major new processing facility in Texas. Interestingly, one of my alumni worked for FMC in the UK, overseeing the processing of Chilean lithium in the 1990s. However, his company decided to move the processing to China to benefit from lower energy and production costs.

There are new mining startups in Canada and, with IRA support, the US, but delivering 20% annual growth throughout the supply chain over the next 20 years is very questionable, especially given today’s lack of diversity. Pundits view lithium as the “new oil”, but if we look back to oil, its average growth, over a comparable period, was just 7%.

It is encouraging to see initiatives to recycle lithium batteries and that cheaper sodium batteries are being considered, but it will be challenging to realise these new technologies in time to meet demand.

China is also investing in its own supply chains, most recently with a mine in Zimbabwe. Unlike other metals, lithium is still not internationally traded, though China has established at least two local trading markets. As Ed Conway concludes in Material World, there is no shortage of lithium, but if the growth rates to meet future demand are to be achieved, what will be the financial, environmental, and political cost? Consideration must be given to technologies which can help reduce this demand.

Nickel, manganese, cobalt, and copper

Demand projections for internationally traded nickel, manganese and cobalt, the smarties in our energy transition, are in the order of 15%, year on year, growth. This reflects expected demand for batteries, but they are also needed for wind turbines and nuclear, with nickel required for the manufacture of fuel cell and electrolyser anodes. Like lithium, these rates are substantially higher than past performance, and major reserves are found in challenging locations. Indeed three-quarters of today’s cobalt originates from the Democratic Republic of the Congo, while two-thirds of cobalt processing is located in China.

Copper is an excellent conductor and used for the manufacture of cables essential for our expanding power grids. EVs and heat pumps also utilise more copper than their conventional counterparts. Extending my energy transition feast analogy, copper provides the cutlery, helping us move our energy (food) around – though perhaps chopsticks would be more appropriate given Chinese dominance.

Demand for copper grew at about 5%, year on year, from the 1990s until Covid struck in 2020, and we can anticipate this rate resuming shortly and continuing well into the 2050s. Reserves to production ratios are stable and so, with a reasonably diversified portfolio of countries, copper may not be as challenged as lithium and the other metals. In his book, Conway still questions copper's future, while Wood Mackenzie forecasts copper could be short if Peru experiences political instability. New large-scale mines, such as Rio Tinto’s Oyu Tolgoi facility in Mongolia, offer increased efficiency and reduced environmental impact, but they also pose longer-term concerns when their output is directly linked to the Chinese market, which already holds 40% of today’s processing capacity. Chatham House is also looking more widely at the impact of largescale mining on local communities.

Graphite

Graphite is another battery component, though it is also used in electric motors and nuclear reactor cores, and could be viewed as the nuts within our energy transition feast; a typical EV contains up to 85kg of the material. Turkey has the largest reserves (27%), while China (22%), and India (21%) rank closely behind, but almost 80% of today’s production is Chinese.

When I was in Tanzania a few years ago, China was looking to purchase graphite from a prospective high-quality mine, and I now see that the Lindi Jumbo project is progressing at pace. This project, which will produce graphite for 500,000 EVs annually, has sold its production to Wogen Pacific, a Hong Kong-Chinese company. China further extends its influence by supplying all the mining equipment under an Engineering, Procurement, and Construction contract.

Land

When we consider the impact humans are having on Earth, one feature often overlooked is our impact on land use. Today, wild animals only account for 4% of the total weight of mammals on the planet, the balance being humans (32%) and domestic animals to support humans (64%).

Energy too is land intensive; wind and solar farms are spatially large and there are discussions over the priorities for farming, housing, forestry, solar farms, or wind projects. Planning for offshore wind has been complex and developers are looking for simplifications to the licensing processes. McKinsey, in a recent review, was spot-on by addressing land, and extending my (already stretched) analogy, perhaps land offers the picnic table for our feast.

Onshore

Most of us enjoy and relish the countryside, but even within our cities there are competing interests for space. Local planning processes are attacked by communities and individuals with conflicting priorities: nimbyism is often seen as a deterrent to progress, stirring resentment.

The energy transition is not going to make this any easier as we look to:

- deploy new power generation technologies, such as solar and wind farms

- site pylons and high voltage transmission lines

- scope new industrial developments, including nuclear projects and gigafactories, particularly around the new cluster complexes

- develop reservoirs and water storage schemes

- reforest for carbon offsets

- grow bio-crops for biofuels

These needs must be accommodated over and above our current infrastructure and land use, and, as the UK Committee for Climate Change (CCC) rightly points out, simultaneously with projects designed to mitigate climate trend consequences – adaptation.

In their land use report, using Germany as an example, McKinsey applied geospatial techniques to assess how much space is needed for renewable technologies. They concluded that Germany’s 2040 emission reduction targets will not be met unless significant changes are made to planning rules. In contrast, Oxford’s Smith School of Enterprise and Environment found that the UK could accommodate sufficient renewables to meet 2050 power needs by dedicating 2% of land to solar, 5% to onshore wind, and 10% of the UK’s exclusive economic zone to offshore wind, though it assumes three-quarters of that would utilise floating turbines – see below.

Conflicting priorities have to be addressed and the Scottish government recently revealed that almost 16 million trees have been cut down since 2000 to accommodate wind farms. As it cut down those trees, perhaps they should have been looking at biofuels, for, as we are aware, the Drax power station is importing wood pellets from the US. In turn, these imports, with shipping and environmental impact, are being debated by many as greenwashing; a virtual circle can become a vicious circle.

Biofuels offer a sensible solution for aviation, but their production depends upon land being prioritised over other uses, and, as for farming, biofuel cropping can lead to water shortages, and pollution of water courses.

Carbon offsetting, through reforestation can have a positive long-term impact, though here consideration must be given to ensuring retention of biodiversity and nature habitats, and some still consider much more needs to be done.

Offshore

The Crown Estate oversees offshore acreage, and procedures have evolved from fishing through to oil and gas licensing. More recently, this has grown to the licensing of wind farms, and future needs may include tidal energy schemes. This planning has ensured retention of shipping corridors and inclusion of marine protection areas.

To date, offshore wind farms have cherry-picked near shore and shallow water locations. Floating wind turbines are being tested, but studies reported by the Energy Monitor show that the costs are currently four times that for seabed structures. This margin will reduce, but I would question some of the trends shown in this report for, while unit costs will drop, tieback distances will increase. Floating wind farms as foreseen by the Smith School will demand resources fir a myriad steel structures and interconnecting cables. Equinor and its partners commissioned the world's largest floating wind farm last month in Norway, supplying power to an offshore platform. McKinsey’s geospatial methodologies should be extended offshore, and, when economic, consideration be given to repowering older wind farms to improve efficiencies, though recycling old blades is not without challenge.

Overseas

We have to recognise that the geospatial capacity of the UK and, indeed NW Europe, is finite. Unconstrained projections for renewable energy will lead to false expectations, limiting 2050+ objectives. Consequently, we must continue to look beyond our borders for supplementary supplies, and energy security.

Many other countries do not have our population and industry density. For example, the US has more degrees of freedom with both space and sun, and thinktanks, such as RethinkX, propose scenarios with unconstrained renewables. North and Southern Africa, the Middle East and Australia are similarly blessed, and have the potential for energy production well beyond their domestic needs, though, as we will see next, water scarcity may be a factor. Energy exports can also provide opportunities for global “levelling-up”.

Energy will continue to be an international commodity either as hydrogen or its derivative ammonia. However, other vectors are being considered; Morocco is looking to export energy via a long-distance cable, Japan is considering e-LNG imports from Peru, and others may look to import biofuels.

Water

Fresh water is already a scarce resource, impacted by both climate change and population growth, and it will become ever more critical over the coming decades. Freshwater accounts for only 3% of world’s water resources and two-thirds of that is frozen; resources are dropping as a result of retreating glaciers, drought, and floods. Of course, we need water in our picnic basket.

Clean water is essential for hydrogen production, and approximately nine litres are needed for each kilogram produced. Only sustainable water supplies should be considered, so inland sites must consider the local hydrological cycle, while, close to the coast, desalination plants powered by renewable energy can be used. This further reduces the efficiency of the hydrogen cycle, but it is estimated desalination will only add +/-5% to the cost of US$2/kg hydrogen and plants could be expanded to meet other local freshwater needs. Waste streams from desalination need to properly diluted, but green oxygen, a byproduct from electrolysis, can oxygenate the effluent.

Continued use of existing infrastructure

Having looked at some of the resource constraints, I would like to finally consider a resource opportunity, adaption of today’s infrastructure. In my last feature, I noted that aviation should utilise bio- and synfuels, allowing continued use of today’s jets. Current plug-in petrol hybrid cars partly depend upon oil, but, as a transitional technology, they are already reducing fossil fuel demand. Another transport example is the continued use of our rail network, upgraded through electrification.

In my feature on heating I looked at replumbing our existing natural gas grid for hydrogen. It is an energy artery, and its conversion will reduce the scale or, at least, defer investment in our power network. The feasibility and benefit depend on safety assessments and the future relative cost of hydrogen to power; the hydrogen “spark gap”. We are also planning to reuse other gas infrastructure for CO2 sequestration.

Widespread replacement of our housing and building infrastructure is just not feasible, and so we must economically adapt and insulate it for the new energy technologies and future climate conditions. As covered in a BBC Radio 4 series, we must reuse much of our current infrastructure for the longer term, perhaps old crockery but still essential for our feast.

Where next for Resources?

One of my favourite cartoon characters is Scott Adams’ Dilbert. In The Dilbert Future, written in 1997, but looking to the 21st century, under prediction 16, Dilbert foresees “scientists will learn how to convert stupidity into clean fuel”. Two of Dilbert’s proposals include utilising the “extra energy” transmitted by the phone company when your telephone rings and throwing your junk mail on the fire to keep warm! He also forecasts viable wind energy not coming from windmill technology, but from the flapping of people’s mouths, harnessed by a critical mass of people and a controversial topic: perhaps that 21st century topic is climate change. Nonetheless, Dilbert may be correct in his prediction, for some (maybe many) say hydrogen is stupid, for, as I have previously discussed, producing green hydrogen is seen as inefficient compared to direct use of power, and it has lower energy density than natural gas.

However, in my previous features I have developed the case for stupid hydrogen to support electrification, providing consumers and industry more choice. I will continue that theme here, for hydrogen can limit demand for both speciality minerals and land. As the Club of Rome thinktank outline in Come On!, our planet is not a limitless resource, and so setting policy without analysis of the realities of our resources is fatuous.

Supply chains for speciality metals offer the greatest concern for translating clean energy targets into actual numbers; we can foresee dramatic increases in demand for materials which are already subject to limited supply chain diversity. Ultimately, many of these materials are recyclable, but the growth needed before a circular economy can be established is staggering. There is a lot of talk about gigafactories for battery production but with insufficient attention to the lithium supply chain, and, although it is the “new oil”, it has yet to benefit from an established commodity market. We question Chinese emissions, but they result from the processing and manufacturing required to meet global consumer demand. The US and Canada have brought together a coalition of countries to address longer term supply of minerals under the Minerals Security Partnership, and, as I write this, they are meeting in London. Today, over 50% of the world’s lithium processing and 80% of the world’s battery manufacturing are based in China.

In my feature on transport, I described how Hydrogen Hybrid EVs (HHEVs) offer consumers efficiency and flexibility. Stupid hydrogen can significantly reduce the demand for batteries and lithium, for HHEVs utilise smaller battery banks. As Sabine Hossenfelder points out in one of her videos, hydrogen has its own resource challenges, but technology diversification reduces deployment risk. A possible +/-50% reduction in the lithium demand would dramatically increase the likelihood of achieving our net zero goal for transport.

Addressing the China problem, the Spanish research institute, CIC energiGUNE, recently looked at how Spain could develop its own energy transition supply chain, and their analysis model could be extended here in the UK as we look to Cornish lithium. Further, perhaps Big Oil should use some of their surplus capital to diversify tomorrow’s supply chains. However, let me add that China is the largest market for wind and renewable hydrogen projects, so they too are moving in the right direction, but perhaps not fast enough to meet our demand for new oil and its derivatives.

The transition to clean energy also calls for a radical rethink of our planning and land allocation processes. In their land report, McKinsey provided some specific recommendations, such as challenging the acceptable distance between renewable energy facilities and existing buildings, upgrading older renewables with more efficient equipment at higher density, and using incentives to counter nimbyism. Such measures are especially needed in heavily populated countries such as the UK with its reducing biodiversity. We must also consider “beyond 2050” as we move to a circular economy and creation of a healthy environment for future generations. Stupid hydrogen can reduce land use if we can store surplus summer energy to meet winter demand and still deliver energy efficiently through a converted gas grid; deployment of hybrid heat pumps will cut the need for contingency renewables and limit new pylons.

McKinsey has identified its top five issues to be addressed within Europe’s energy transition. Supply chains and land were first and third on the list and they offer a range of solutions. However, I believe McKinsey have yet to fully grasp the potential for synergies between hydrogen and renewables. Yes, hydrogen is stupid, but it offers flexibility and can fine-tune an electrified economy, punching above its weight when we look at exposure to critical supply chains, land use, and modifications needed to existing infrastructure.

Our engineering community has a key role to play collaborating on new technologies, looking for synergies, and acting globally to ensure we enjoy feast over famine. In particular, chemical engineers can apply their systems thinking as we redevelop our integrated energy system and its supply chains. We have a duty to help policymakers appreciate these resource challenges and opportunities so that they can present viable net zero policies and plans.

Recent Editions

Catch up on the latest news, views and jobs from The Chemical Engineer. Below are the four latest issues. View a wider selection of the archive from within the Magazine section of this site.