Engineering Net Zero Part 7: Energy Security and Affordability

In his penultimate Engineering Net Zero feature, David Simmonds considers the structure of the energy market and how it needs to change to achieve net zero

MODELLING for the National Infrastructure Commission (NIC), Aurora Energy hailed the challenges of achieving net zero as our Energy Trilemma; decarbonisation, security of supply and minimising cost. McKinsey, in a very recent post for COP28, added a fourth dimension, industrial competitiveness. The relative importance of these parameters has changed over the two years following the outbreak of the Russia-Ukraine war and subsequent cost of living crisis, and it is clear from public sentiment that we will not achieve net zero without securing affordable and reliable energy resources.

Early in 2023, recognising these challenges, Rishi Sunak split the UK’s Department for Business, Energy and Industrial Strategy, creating three new departments, including Energy Security and Net Zero (DESNZ). While not included in the title, DESNZ also has both energy affordability and the needs of our beleaguered industries in its crosshairs.

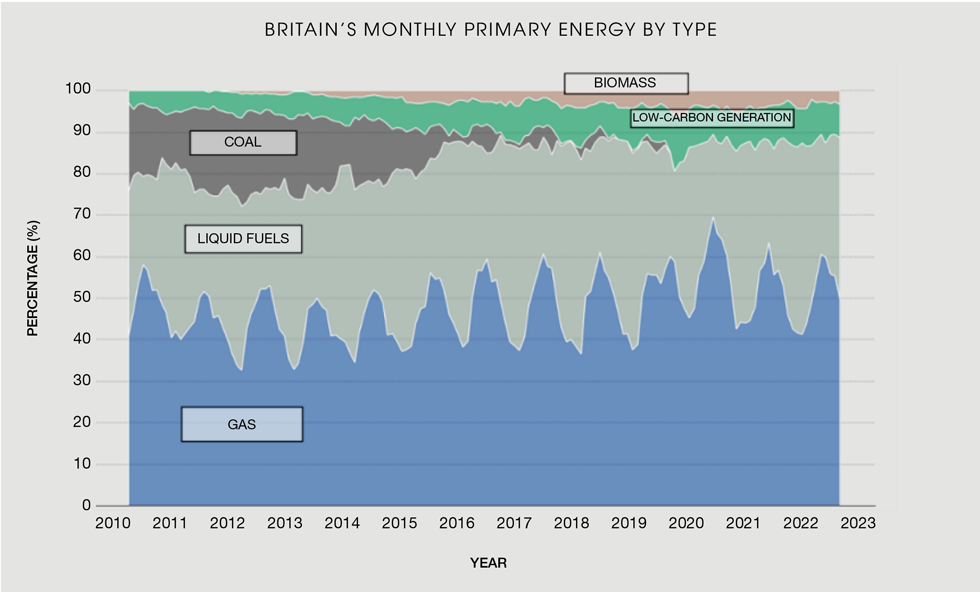

We have been congratulating ourselves on achieving 40+% of our power from renewable resources at low cost, but the following chart crystalises the decarbonisation challenge, for power comprises only a fraction of total energy consumption. Biomass and low carbon generation represent just +/-15% of our energy utilisation, with “cheap” fossil fuels still responsible for 80% of our energy needs. Further, we experience a winter to summer energy demand cycle, gas for heating in the winter and oil for transport in the summer. While 20 years ago we were energy self-sufficient, today we have to import much of that oil and gas, impacting both price and energy security.

So, following the wide-ranging discussions in my prior features, how can we secure solutions to the Quadlemma? Having considered industry previously, this feature looks at net zero from the interlinked perspectives of pricing and security of supply.

Energy pricing

Today’s energy market is set by international demand. Petrol and diesel prices are established through international trading, though government taxation and wholesaler margins must be added. In contrast, domestic gas and electricity prices are capped, with consumer pricing calculated from a look ahead of wholesale prices of natural gas. Most of today’s renewable energy projects are developed under Contracts for Difference (CfD) agreements, with the government subsidising or benefiting from the contracted strike price (the predetermined price at which a specific security may be purchased or sold). As we have seen, the 2023 offshore wind round did not attract any offers, and the UK government has been forced to increase the maximum strike price for next year’s auction.

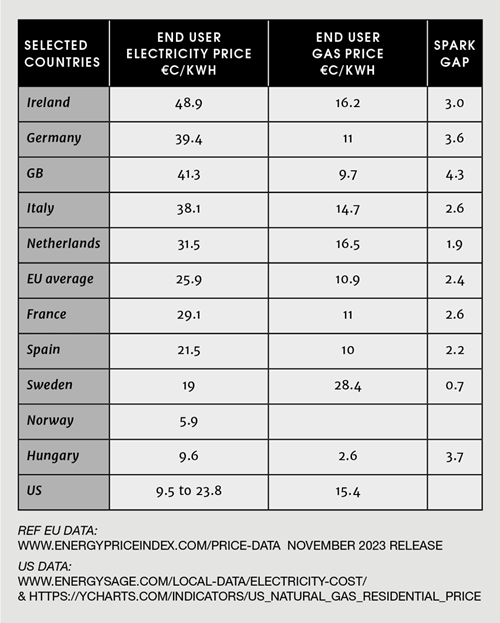

As can be seen from the table on the left, there are marked differences in electricity and gas pricing across Europe. From this data I have calculated the “spark gap” as discussed in my Engineering Net Zero feature on heating, and we can see there are wide discrepancies for the same commodity, with the Swedish spark gap currently below 1.

The current UK domestic capped prices are 28.62 and 7.42 £p/kWh – still a spark gap of 3.85.

Greening electricity

While gas prices are reasonably uniform across major EU markets, there is a wider variance on electricity, with the UK at the top end, only behind Ireland, which receives much of its energy from the UK. With its premium electricity price, the UK goes on to realise the highest spark gap, reducing the incentive for consumers to switch to heat pumps and for the UK to otherwise electrify its economy.

There are some special cases, as, for example, Norwegian electricity is cheap due to much being produced from hydropower, and perhaps this explains why one of my Norwegian GPA colleagues can afford to consume 30,000 kWh annually. Indeed, despite producing significant quantities of gas for export, Norway consumes little domestically, and its neighbour, Sweden only has limited supplies. Sweden imposes both an energy and carbon tax on all fuels including those used domestically, and so natural gas incurs a particular penalty. I added the US for comparison, as electricity prices vary greatly across the country, with the highest in California and the lowest in and around the gas-producing states of the Midwest.

As renewables increase their share of the electricity market, pundits rightly raise the case for lower prices, perhaps linked directly to the CfD strike price. Electricity is a simple commodity with sources aggregated within the grid, and efforts to compare relative costs have used a mechanism called the levelized cost of electricity (LCOE). We have been able to easily compare gas, coal, or oil-powered resources, as they operate similarly to match demand. When we introduced nuclear into the mix, we had to cope with the fact that it operates as base load, but LCOE principles, which I don’t have the space to go into here, have been adapted. The International Renewable Energy Agency, IRENA, prepares annual reports on renewable power generation and goes on to use LCOE to compare performance. However, extending LCOE to renewables is complicated by intermittent operation, for the wind does not always blow, nor the sun shine, and the challenges in making LCOE comparisons are discussed further here.

As we have already seen in my series, here in the UK, offshore wind operates at 40-45% average capacity, onshore at less than 35%, and solar down at about 15%. As availability does not match demand, our future system needs to consider times of surplus and shortfalls, the latter met through stored energy and/or back-up power (see more in the discussion below on energy security). Further, each wind or solar farm resource must be tied back to the grid for its rated output. These considerations must be built into cost comparisons, and so a simple statement that a solar farm generating at £45/MWh or a wind farm generating at £75 must be better value than a nuclear plant at £150 or a gas plant at £100 demands much more analysis. Costs have to be compared on a “total system basis” operating over a year, and even then, capacity and storage redundancy have to be built in to allow for exceptional years with extended periods of cold weather and/or low wind. Today, gas plants are being retained at reduced utilisation rates to back up intermittent renewables.

Nonetheless, as technology improvements and scale play out, costs for renewables have dropped significantly, and, as we have seen in an earlier article, RethinkX forecasts further reductions in cost for SWB (solar, wind, battery) systems. However, as already noted, contracts for the next UK wind round will be higher than those awarded in 2022, and as we move further offshore, floating wind creates a step change in cost. Nuclear power costs have remained high, but it is hoped the unit costs for smaller modular reactors (SMRs) will reduce following scaleup and repeatability. Unfortunately, we are not yet there.

While we have seen some sharp spikes when we import energy at times of high demand, wholesale prices are relatively constant. However, as we fully decarbonise our power supplies, energy retailers can anticipate more regular price swings due to renewables shortages and surpluses – again to be discussed in the next section. Today, consumers do not see these spikes or swings, as they enjoy a fixed tariff, now typically set every three months. As prices rose quickly during the run-up to the invasion of Ukraine, a number of UK energy retailers collapsed as they had not adequately hedged their wholesale supplies. In light of these trends, particularly as demand grows and we incorporate greener “reserve” power supplies, forecasters do not foresee UK electricity prices dropping any time soon.

Gas, liquid fuels, and a transition to hydrogen

While the electricity transition is challenging, moving away from “cheap” gas and oil to hydrogen and e-fuels, storable and tradable energy vectors, will be harder. As we have seen, with today’s fossil fuel prices and the low taxation on domestic energy, it is uneconomic for most consumers and businesses to electrify. On the other hand, higher duties on petrol and diesel are helping to incentivise drivers to switch. However, fuel duties provide the Exchequer with significant income, and, as electric vehicles (EVs) increase their market share, the government will be looking to alternative ways to raise funds, including, for instance, a mileage tax. This may need to be applied uniformly across electric, petrol and diesel cars, though the technology may be difficult to retrofit to older vehicles.

As electricity prices are unlikely to drop significantly, governments will be forced to consider carbon taxes on fossil fuels for heating to incentivise conversion to cleaner energy. Industry is already starting to bear these charges, though if not applied internationally, they will affect competitivity. Extending carbon taxes to the consumer market will be politically more challenging, but as we have seen, it is already happening in the Nordic countries.

As we move forward, hydrogen will become an alternative fuel, produced from natural gas (blue hydrogen) or from electricity, (green or pink hydrogen). We can foresee that kWh for kWh, blue hydrogen, when produced at scale, will typically be twice the price of natural gas (see reference slide 14 of Aurora study). Per kWh, this will still be cheaper than electricity. However, for heating, when efficient heat pumps are utilised, hydrogen will be more expensive (though heat pump system installation costs for older properties and lack of experienced installers will remain hurdles to widespread deployment). I have talked about conversion of the gas grid in prior features, but the challenges and cost of this cannot be underestimated.

Eventually, hydrogen will primarily be produced from the electrolysis of water, and so by definition it will be more expensive than direct use of that power. However, as we have seen, wholesale electricity prices will fluctuate as a result of supply and demand, and green/pink hydrogen will be produced at times of surplus, when power prices are cheap. As a storable energy vector, hydrogen will be used to meet peak power demand. The summer to winter differential, exemplified by my personal electricity patterns discussed my feature on heating, will drive the economics for the hydrogen cycle, to produce energy “atoms” which can be stored and traded more efficiently than “electrons”. Hydrogen will only meet a fraction of total energy demand, but it will become the essential balancing component within our energy system. It will also become a traded commodity, much as gas (including LNG (liquefied natural gas)) and oil are today, and ultimately its wholesale price will be established by international demand.

Energy forecasters have differing views on the relative cost of blue and green hydrogen, especially as it is also a function of natural gas prices. It is unlikely that green hydrogen will be cheaper than blue until the second half of the next decade at the earliest, and so, today, blue hydrogen makes up the majority of the prospective hydrogen portfolio.

I have focused on hydrogen, but biofuels and synfuels will compete in the future energy market and as outlined in my feature on industry, they will be important for the aviation sector. They too will be expensive, and there are uncertainties over their future competitiveness. Synfuels depend upon hydrogen and so one can see a further layer of cost going into their manufacture. That cost can be offset against savings, including the ability to extend the life of today’s infrastructure, such as a our aircraft fleet, but biofuels are dependent upon agricultural production and will compete for land use.

Government response to energy pricing

Recognising the challenges of the future market, the UK government has been forcing energy retail companies to roll out smart meters (for both electricity and gas), measuring consumer use at intervals of 30 minutes or less. These are already being used to incentivise consumers to reduce demand during peak periods, through schemes as operated by Centrica and others during winter. As demand grows from deployment of heat pumps and EVs, the “carrot” approach will morph towards a more radical change to the retail market with half-hourly “smart” billing to cover actual cost. Many customers will view this as a “stick”, though a few, whose lifestyles are not set by firm schedules, may benefit.

Denationalisation of energy markets introduced competition and, until the recent energy crisis, consumers were able to shop around for deals on their gas and electricity. Following the sharp increases in wholesale prices due to the Russia-Ukraine war, the government was forced to introduce price caps, effectively eliminating retail competition. Indeed, when wholesale prices were rising, retail suppliers had to compete for their purchases, adding to the price pressure. Now prices are stabilising, the government hopes to restore the retail market. However, as we move towards “smart” pricing to manage demand, it will become ever more difficult to compare suppliers’ offerings, especially as the cost risk moves over to the consumer.

Last year I wrote a separate article for the European Chapter of the Gas Processor’s Association, on why we need to radically alter the way our energy retail sector works if we want to secure the changes needed to decarbonise and accommodate renewables. The Royal Society, in its recent look at large-scale electricity storage, commented similarly in Chapter 9 of its report, stating that: “it is widely recognised that reaching net zero emissions cost-effectively will require an unprecedented level of coordination and a “whole system” approach that extends across the energy sector. It is difficult to imagine existing markets and regulations delivering a portfolio of generation and storage that would lead cost-effectively to a net zero electricity system or ensuring the operational coordination necessary to control costs. If alternatives are not adopted before large-scale storage is needed, not enough will be built”. This reinforces the need for a “systems approach” to evaluating future needs, and their proposed solutions include centrally driven investment plans such as happen in France and Germany, close cooperation of power pools as occurs in the US, or the creation of a “central buyer” of energy. Allocation of risk between consumer, retail suppliers, energy producers, and government as we decarbonise, is at the heart of the future pricing conundrum, and government has yet to face up to the challenges of pricing and taxation. Indeed, many view the imposition of a charge on boiler manufacturers, when they don’t meet heat pump sales targets, as just another stealth tax.

Energy security

We will certainly not deliver net zero without security of supplies. The embargo on Russia led to supply shortages and a significant hike in international prices, a repeat of the situation in the 1970s when war broke out in the Middle East. IChemE recently responded to the government consultation Keeping the Power On, which looked at how the energy mix of the UK will need to change to meet net zero demands, and its response featured a range of recommendations.

Working on that consultation, I connected with Andrew Haslett who had responded on prior government consultations. Helpfully, he started our discussions by framing the importance of energy security, by stating “energy provides economically and socially critical services to households and businesses…such as mobility, cleanliness, comfort, food preparation and preservation, communication etc. Many of these are not discretionary for the households and businesses that purchase energy – energy is vital for their well-being”.

With help from the National Renewable Energy Laboratory, Haslett went on to categorise energy security under:

- Resource adequacy: having enough power available through generation and sufficient transmission capacity to move the power from where it is produced, stored, and used

- Operational reliability: having enough redundancy to cope with failures and events such as routine maintenance and loss incidents

- Strategic resilience: having a whole system design that is less vulnerable to and better able to recover from system shocks caused by geopolitical stresses, weather, and other natural events

Resource adequacy and strategic resilience

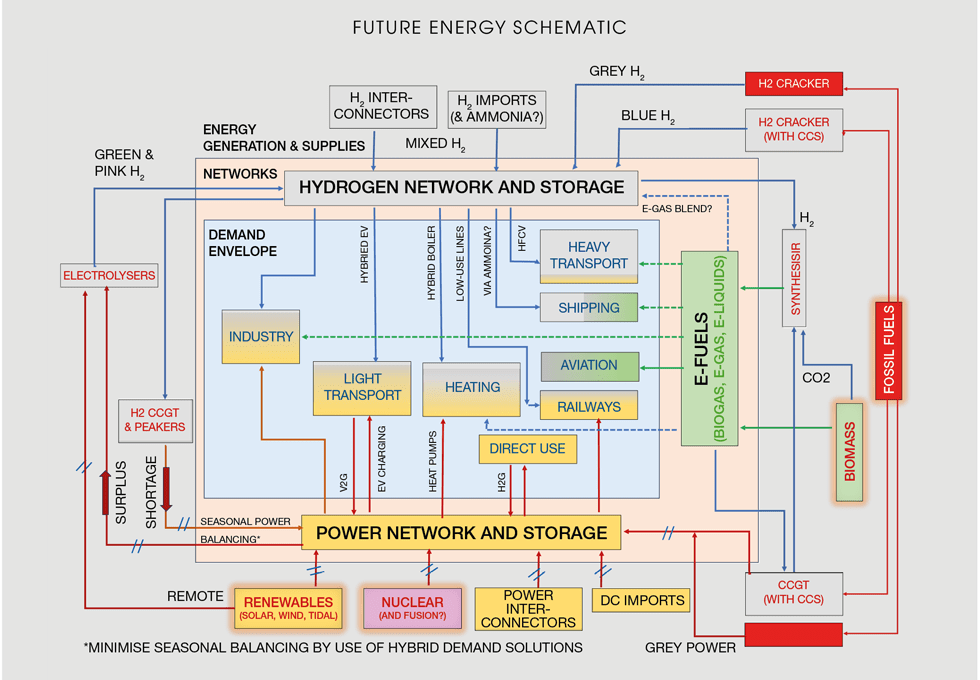

In previous features and in the foregoing discussion on price, I have stressed the need to consider our energy system holistically, and this is even more important when one considers adequacy and resilience. To this end I have developed the following schematic as my understanding of our future energy system.

Today’s energy system comprises four key resources – coal, oil, natural gas, and power (electricity) – with fossil fuels meeting over 80% of demand and operates with a high degree of reliability. Tomorrow’s system, with electricity at its heart, needs to be supported by hydrogen and e-fuels to meet demand from hard to convert sectors and to match today’s reliability. The schematic shows the four primary resources; renewables, nuclear, biomass, and fossil fuels, with the latter to be phased out over time. Until that happens, the impact of fossil fuels must be abated through carbon capture and the production of blue hydrogen.

The main purpose of the schematic is to highlight how electricity and hydrogen can work together to enhance adequacy and resilience for consumers, business, and industry. A number of energy system models have been developed to forecast future energy balances and generation capacity. These include Aurora studies for NIC, Imperial College’s work for the Carbon Trust, Oxford University’s work for the Royal Society, and AFRY’s for the Committee for Climate Change, though, as far as I can see, none include a suitable system diagram for operational explanation. It’s only through detailed reading of the reports does one start to appreciate how future demand will be met, and only the earlier AFRY and Imperial College work consider hybrid technologies.

As we have seen, the main challenges for a future electrified economy are the intermittency of renewables and the seasonal demand of heating. This leads to the need to balance the system or network as provided for on the lefthand side of the schematic. Usually, energy system models consider utilisation of “surplus” energy to produce hydrogen, which can be stored and subsequently burnt in power plants to generate electricity during periods of shortage. However, different assumptions over future energy production and demand lead to a range of results for levels of electrolysis, hydrogen storage, and back-up power generation. Each serves a different parameter. Electrolysis manages surplus power and is critical for system efficiency but not so security. Hydrogen storage provides resilience, ensuring sufficient energy to cope with extended periods of demand or renewables shortfall, while back-up power generation using hydrogen is required for resilience and adequacy. Furthermore, the grid infrastructure has to be designed and built to deliver that power to market and the scale of this is only now being fully appreciated both here in the UK and the US.

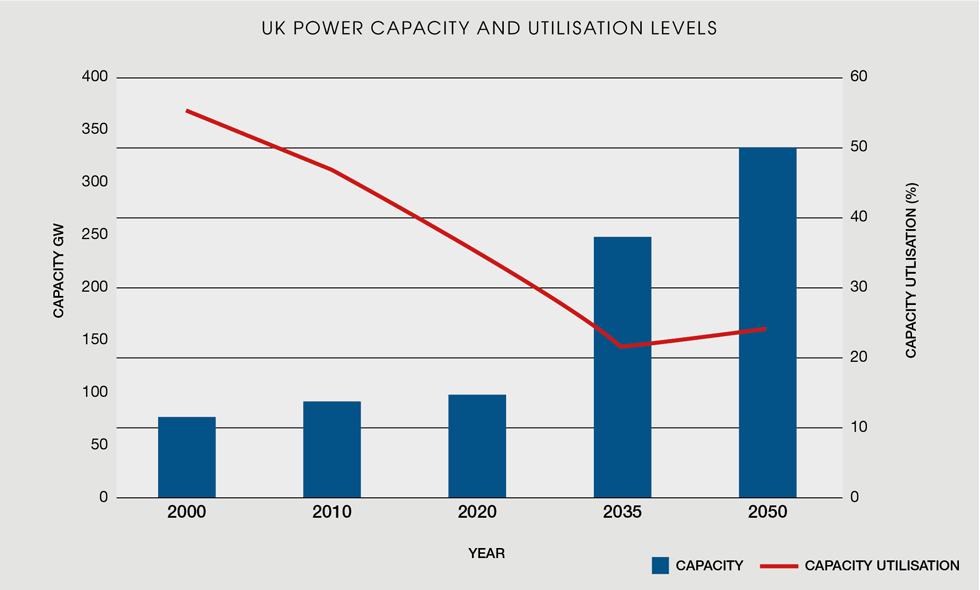

To illustrate the challenge, I developed the following chart showing the trending of UK-installed generation capacity and its utilisation, using actual data for 2000–2020 and forecasts from the Aurora model (for NIC) for 2035 and 2050.

Over the last 20 years, generation capacity utilisation has dropped from 55% to less than 35%. This is due to lower demand, as a result of energy efficiency measures and outsourcing industry, and the significant deployment of renewables with their lower average outputs. This trend continues to less than 25%, as we move forward to 2035 by when the government hopes to achieve full decarbonisation of the sector. The significant increases in installed capacity for 2035 and 2050 reflect both the intermittency of renewables and demand growth from electrification. Post 2035, generation utilisation rates stabilise or slightly increase as Aurora consider implementation of improved flexibility measures across all demand sectors.

The chart highlights the scale of the capacity build needed to meet net zero and the relative “inefficiency” of renewables, and reinforces the knock-on impact to our power grid as it expands to ensure secure supplies to all consumers (see also BEIS 2022 Studies).

What surprised me when looking at the energy modelling, is that, typically, we need between 50–100 TWh of reserve energy storage and anywhere up to 40 GW of back-up generation capacity (included within the 2050 capacity datum point), both of which require significant investment. When working on the Gasunie studies for Groningen gas in the 1990s, we had to consider significant expenditure on back-up capacity and storage measures, and these were implemented by Gasunie under the umbrella of their centrally managed system. Delivering similar energy resilience measures for our future electricity network in a competitive market environment will be challenging.

Energy security can also be enhanced through increasing interconnector capacity, as planned with the new Viking interconnector to Denmark, though these also open vulnerability to wider escalations (aka the European gas and power needs at the start of the Russia-Ukraine war). Import options can also enhance security of supplies, and as already mentioned, hydrogen will become an internationally traded commodity. Importing power is also feasible and likely from Norway, and schemes are afoot to import power from as far away as Morocco, but long distance subsea cables and pipelines increase the security threat, and, like interconnectors, proffer a two edged sword.

The schematic shows another way to meet consumer demand at periods of peak demand, by utilising hydrogen directly in hybrid technologies. I developed a case for hybrids in my earlier features on transport and heating, and I will explore them further in my final feature which will summarise my Engineering Net Zero journey, demonstrating how hybrids can benefit consumers and reduce infrastructure requirements.

Operational resilience

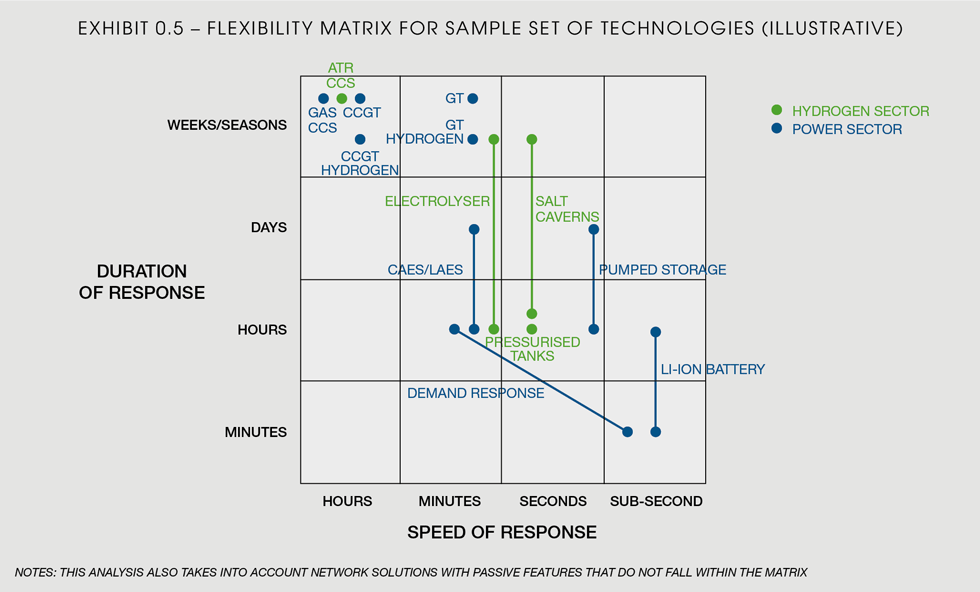

Operational reliability demands more immediate flexibility measures and there are a number of ways these can be provided, as shown in the chart below (courtesy of AFRY) which considers both speed and duration of response.

Batteries are the primary solution for fast and short-term grid reinforcement, and there are many ongoing examples such as in northeast Australia. My energy system schematic also includes V2G (Vehicle to Grid) and H2G (Home to Grid) options utilising consumers’ car and home battery systems to boost capacity. Smarter “managed” charging of our electric vehicle fleet is another demand control measure, something Aurora considers as we upgrade our EV fleet from “dumb” to “smart” EVs.

Although renewable energy resources are more diverse, they do place additional operational burden on the network, as witnessed with the cascade incident in East Anglia in August 2019 and the power system failure in Texas in February 2021. The instantaneous loss of a renewables supply can put the whole network at risk, for it takes time to bring other resources online. Professor Strbac of Imperial College London and others are now including system stability assessments into their modelling of our energy system to ensure future designs are sufficiently robust.

Final thoughts on pricing and energy security

Energy pricing and security are the last pieces of the jigsaw before I bring together my overall thoughts on Engineering Net Zero. It is easy to superficially look at our energy system and say the answer is either “a” or “b” based upon efficiency, flexibility, or other criteria, but full system modelling, skills held by chemical engineers, must consider the impact of pricing and security of supplies. Professor Strbac’s team at Imperial College consider assumptions for both in their recent studies for Cadent, but the enormous expenditures of £86bn and £91bn annually to 2050, for their hydrogen and electrification cases respectively, highlight the scale of the challenge. The cost differences between the options are certainly within any estimating accuracy, and therefore their team have looked at a range of sensitivities. Strbac noted when I met him, that as per his earlier studies, directionally hybrid technologies will again be of lowest cost, but unfortunately his team were not asked to look at that option.

Aurora in their study on decarbonising heating for NIC concludes that heating with hydrogen is likely to both cost more and lead to higher emissions without looking at the fact that the power grid needs hydrogen anyway for balancing and to meet peak demands. Further, they did not study a hybrid heating option. Consequently, it is essential we look at all options holistically, on a total system basis.

Some key questions we need to ask include:

Local vs import?

Ideally, local or “homegrown” solutions offer the lowest security risk, and that is why many pundits are pushing for development of Cumbrian coal, UK fracking, and extended licensing of North Sea oil and gas. These fossil fuel solutions would enhance our energy security as they can satisfy 24/365 demands, but clearly, they fail to support our longer-term goals for net zero.

Similarly, developing our own renewable energy supplies will tick many boxes, but there may be reducing returns as we expand them; for example, moving wind farms further offshore and into deeper water, and utilising farmland for solar. Other countries may offer lower cost renewable energy supplies allowing, for example, cheaper green hydrogen to be produced from solar energy generated in sunnier climes.

Last year the UK imported a record amount of electricity through its interconnectors with France, Belgium, and Norway. This year we will start to see imports from Denmark via the Viking link, and I fear the EU see the UK as a good market due to our higher electricity prices. However, we need to diversify resources as best we can, and retain levels of redundancy.

How much energy storage should we provide?

Firstly, our energy system needs to build in as much flexibility as possible, through such measures as smart metering and charging. After that, redundancy and resilience come from energy storage, and, as we have seen from LNG, from the ability to trade energy. To establish the required levels of storage the government needs to set resilience standards, much as I had to consider for Groningen back in the mid-90s where we had to meet demand of the one in 100-year winter.

At the end of 2023, the EU had approximately 1,000 TWh of natural gas in storage, while the UK had just 1% of that level.

We also have to consider the alternatives, such as batteries, hydrogen storage, and liquid e-fuels, which leads to the next question…

Does a multi-vector solution offer more resilience?

Many question the overreliance on a single-vector solution, something which should be addressed at both operational and technological levels. Today, many consumers have alternative ways to heat their homes or to travel, but a future dependent upon a single vector offers significant risk.

Further, our energy transition is dependent upon a number of key technologies. If we overly rely on a particular technology, which could be subject to a supply chain constraint (eg lithium), or a resource constraint (eg heat pump installers), we can place the whole transition at risk and potential higher cost.

Can we afford the energy transition?

The cost numbers indicated in the Imperial and other studies are very significant, almost equivalent to delivering HS2 every year. Rupert Darwall in his latest essay for the RealClear Foundation concludes that we can’t afford net zero and recommends that the project is abandoned. Here in the UK, it can only be delivered through investment by the private sector, and the traditional oil and gas companies should be leveraged as they have capital, competencies, and resources. Further, as I highlighted in my very first piece it needs a clear "realisable" pathway with effective policy decisions, something which we can now see was missing with HS2.

The UK government is establishing an Independent System Operator (ISOP). Its remit primarily oversees operation of our power networks, with more limited planning of our gas network. Personally, I strongly believe we need an Energy System Operator overseeing an integrated energy system as shown in my schematic. Savings will come from capturing synergies at all levels, and working with other counties, aligning on standards and implementation goals.

Further, we need to consider today’s competitive retail market model, for the current network balancing model introduced to facilitate the competition will not support our transition. We need to listen to the Royal Society and consider alternatives.

The US$64,000 question not answered by Darwall is; can we afford not to deliver the transition?

Should we introduce carbon taxes on domestic fuels?

The spark gap poses a real threat to resolving the Quadlemma, and so I believe the UK will be forced to adopt the Nordic lead in wider application of carbon taxes to provide a level playing field for renewable energy and biofuels. Currently, the UK favours application of incentives to clean technologies but, given the state of the public purse, this is unlikely to prevail. My personal view is that we have long seen "cheap" energy as a way out of our economic difficulties; the end of that road is in sight.

Our engineering community helped us turn around the economy after the energy price shocks of the 1970s, and we have to repeat that clarity of vision. Indeed, a robust plan for net zero based upon full system analysis, will allow government to properly implement carbon taxes which can be used to offset subsidies or grants for new technologies.

Why aren’t we considering hybrid technologies?

Pass! They offer lower cost, more choice, redundancy, and resilience and should be fully considered in future studies and ultimately be part of the plan.

Recent Editions

Catch up on the latest news, views and jobs from The Chemical Engineer. Below are the four latest issues. View a wider selection of the archive from within the Magazine section of this site.