The Role of Biofuels in Energy Transitions

Looking ahead, Tod McGreevy and Ramin Lakani discuss the shifting dynamics of oil, gas and biofuels used for transportation, and their industries’ part to play in a greener future

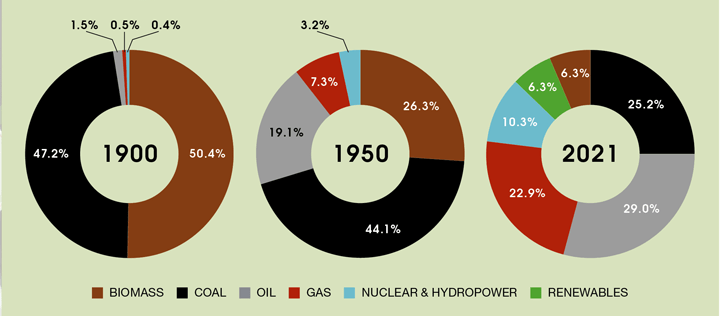

ENERGY has entered the era of “energy transition”, featuring a shift from fossil fuels towards renewable energy sources. The world has seen energy transitions before (see Figure 1) – from biomass (wood) to coal during the industrial revolution, and then from coal to oil in the 20th century. The current global energy mix is moving to natural gas as the preferred “transition fuel” and to the development of renewable sources. Meanwhile, the demand for energy is growing, driven by economic and population growth. Considering that over 70% of increased energy requirements are from developing countries, led by China and India, energy demand is expected to grow further in the future. The world wants more energy but less carbon, but considering the war in Ukraine and global inflation, energy security and affordability have also become elevated risks for many countries.

How does the oil and gas (O&G) industry fit in this complex dynamic between energy transition, security, and affordability? O&G provide more than 50% of global primary energy demand and more than 90% of transport fuels. However, this dominant position will not continue unless fundamental changes are implemented by the energy industry, which is facing key challenges:

- realising energy transitions;

- sustained pressure from investors to reduce carbon footprint;

- proven green credentials for new talent entering the O&G industry; and the

- threat of governments discontinuing O&G industry’s “Licence to Operate”.

This article will focus on transport and its carbon footprint, which is considered harder to abate than other sectors, such as power. Emphasis will be on road and air transport markets, showing that biofuels, including renewable diesel (RD) and sustainable aviation fuel (SAF), could play important roles in the decarbonisation of the transport sector.

Biofuels overview

Liquid biofuels are derived from biological material such as plants, trees, crops, animal fats, or agricultural wastes. Biofuels can be produced from any carbon source that can be replenished periodically from renewable sources rather than fossil fuels.

Road and air transport biofuels can be categorised as follows:

Ethanol

An alcohol produced by fermentation using sugar cane, corn, or wheat as feedstocks. Ethanol from cellulosic matter (wood) is possible but not fully commercialised. Ethanol has a high octane rating of 113 (a measure of gasoline quality) that’s added to gasoline. For example, regular British petrol (95 octane) must have at least 10% ethanol (E10 fuel).

Biodiesel

The “first generation” or legacy biofuel, produced via transesterification of oils or fats using methanol as a reactant. This legacy biodiesel is sometimes called fatty acid methyl ester (FAME) and is limited to no more than 20% blended with petroleum diesel for retail sales because of well-documented quality issues including a tendency to gel in cold weather, affinity for water (leads to fuel degradation), troublesome separation issues in storage and distribution systems, and only having about 88% of the energy content of petroleum diesel.

Renewable diesel (RD)

RD is a “second generation” biofuel, mainly produced by mature refining processes called hydrotreating/isomerisation. These catalytic processes convert vegetable oils and animal fats in the presence of hydrogen into molecules similar to petroleum diesel, using existing petroleum distribution systems (pipelines, storage, etc). RD has a high cetane number of 70 (a measure of diesel quality), does not suffer from biodiesel’s quality issues, and is a cleaner burning substitute than petroleum diesel. It has the same energy content as petroleum diesel and can also be a 100% drop-in replacement for it. Other terms used for RD are hydrogenated vegetable oil (HVO), hydrogenation derived renewable diesel (HDRD), hydrogenated esters and fatty acids (HEFA), or hydrogenated biodiesel (HBD).

Sustainable aviation fuel (SAF)

Sometimes called “biojet”, it has similar properties to conventional jet fuel so that it can be used in aircrafts without adaptation or modification. According to the European Environmental Agency, SAF is defined as a “bio-based aviation fuel that reduces GHG emissions relative to conventional aviation fuel, while avoiding other adverse sustainability impacts.” There are several pathways to make SAF. The most common route makes renewable hydro-processed jet fuel, which is called hydro-processed esters and fatty acids synthetic paraffinic kerosene (HEFA-SPK). This type of SAF is produced similarly to RD and currently has a maximum blend limit of 50% in commercial aviation industry. HEFA-SPK is considered a “drop-in” fuel, which is compatible with existing jet engines, has a freeze point of -47°C with no storage issues, and does not accumulate water (ie easy to transport and store in existing infrastructure).

Biofuels in the transport sector

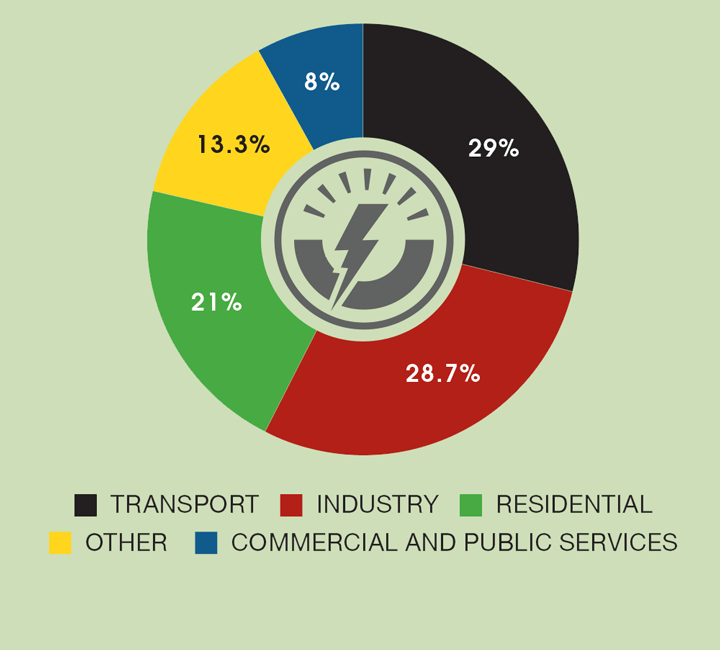

The transport sector is the highest global consumer of energy, with around 30% of total energy consumption according to International Energy Agency (IEA) (see Figure 2). To meet overall emissions reduction targets, governments have responded by incentivising lower emissions from the transport sector. The general approach is that, if possible, transport should be electrified. Where electrification is implausible or unavailable (eg commercial aviation), then biofuels can step in.

Apart from reducing the carbon footprint, biofuels have the following benefits for the transport sector:

- they contribute to energy independence – many feedstocks such as used cooking oil (UCO), animal fats, and vegetable oils could be supplied locally;

- impact rural and agricultural development – the supply chain for feedstocks could revive local economies without competing with human food chain since those used for biofuels aren’t considered “human food grade”;

- promote the circular economy – some feedstocks used for RD/SAF production are waste materials, which pose a burden for landfill sites or other disposal routes. For example, palm oil mill effluent (POME); and they

- utilise existing O&G infrastructure.

Interaction of feedstocks and project economics

The choice of the renewable feedstock is one of the most important decisions for the RD/SAF project developer. Usually, the feedstock needs pre-treatment to meet the design specifications of the RD/SAF process units. In fact, RD/SAF plant owners may decide to co-locate the feedstock pre-treatment plant to improve supply chain, increase quality control, and reduce transport costs. In some cases, RD/SAF plant owners may form an alliance with a feedstock pre-treatment company or invest in the facilities. However, in most cases, pre-treatment is done by a third party in a different location and the RD/SAF operator signs a supply agreement.

There are many contaminants that need to be removed from raw feedstocks:

- halide salts such as sodium chloride to avoid corrosion in the system;

- free fatty acids that could cause plugging of the catalyst as well as corrosion;

- solids and particulates which could cause plugging; and

- heavy metals that could affect the performance of the catalyst.

The selection of the renewable feedstocks is a complex techno-economic decision, inter-related with supply chain and logistics issues. RD/SAF producers have multiple feedstock options, each presenting different sets of opportunities and challenges such as accessibility, availability, pricing, government policy, product yield, and catalyst life.

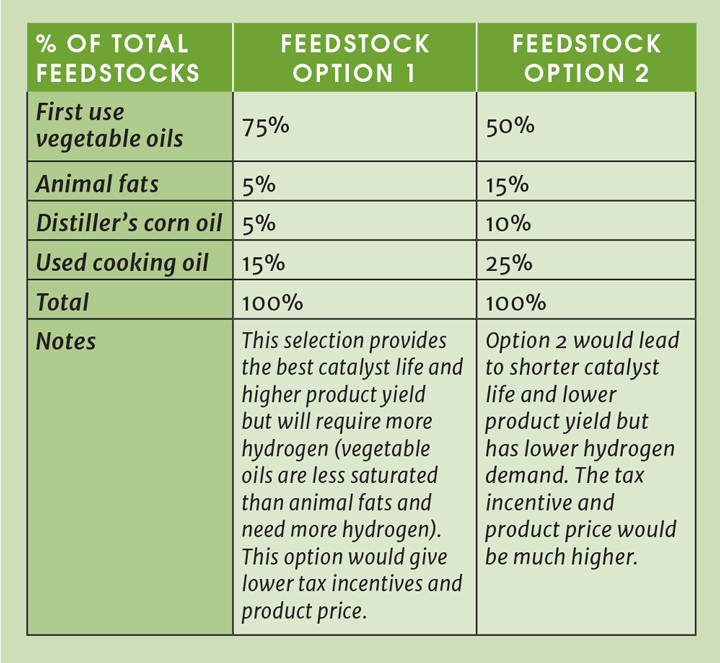

With petroleum-based products, buyers don’t typically consider the origin of the crude oil that was used, as long the products meet certain standards. However, biofuels buyers want to know the feedstocks and the processes that were used. Such details could impact the tax breaks/incentives that could be claimed for that product and hence the biofuel price. For example, the RD tax incentive – which influences the sales price – could be significant if the feedstock is UCO as opposed to rapeseed oil (see Table 1).

The primary renewable feedstock groups are as follows:

- first-use vegetable oils (eg rapeseed oil);

- animal fats (tallow);

- distiller’s corn oil;

- UCO; and

- “tall oil”, which is a residual product of the pulp and paper industry, mostly used in Scandinavia.

The biggest producers of RD/SAF are Europe and the US, which are also the biggest consumers of biofuels. Both regions provide incentives to encourage the production of biofuels. In the US, biofuels are a mandated product that need to be blended with the conventional fuels to meet existing federal renewable fuel standard (RFS) statutes and state-level low carbon fuel standard (LCFS) programs. Renewable identification number (RIN) prices, LCFS prices, and federal blender’s tax credit interact with feedstock costs and product yield to influence the product margins and hence the project economics. The Inflation Reduction Act that was passed in the US in 2022 provides additional incentives for RD/SAF production. The European Union (EU) has adopted the renewable energy directive (RED) system that penalises retailers that don’t meet the minimum amount of renewable fuels in their products.

The EU also emphasises the sustainability criteria of biofuels, including the negative direct impact that the production of biofuel feedstocks may have due to indirect land use change (ILUC). Because of deforestation in the Amazon and South Asian rainforests, the EU RED denotes crops grown in such areas as “high ILUC risk” feedstocks, hence the credit provided for them is either removed or reduced. ILUC was conceived to avoid a situation where rising feedstock prices create incentives to divert existing agricultural land to biofuel production, causing supply shortages of animal or human food. In the UK, the renewable transport fuel obligation (RTFO) system is used, which has similarities to the EU RED directive and allows civil penalties for non-compliant retailers.

RD and SAF production processes

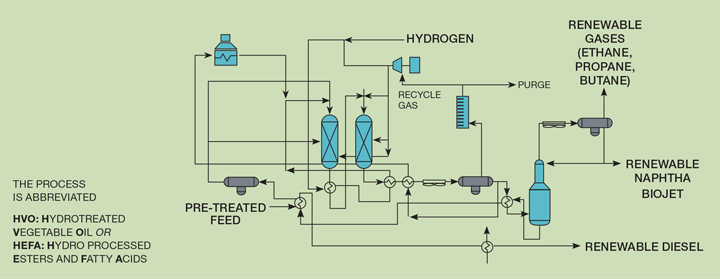

There are many process pathways to make RD/SAF, but the most mature and scalable process is hydrotreating. The refining process to make RD (see Figure 3) can be explained in three steps:

- various feedstocks (eg a mix of vegetable oils and animal fats) are pre-treated;

- hydrotreatment of the feedstock occurs in a catalytic reactor with added hydrogen, allowing the removal of oxygen and saturating the carbon-hydrogen double bonds; and then

- hydro-isomerisation, where straight chain molecules are converted to branched chain molecules, in a catalytic reactor in the presence of hydrogen.

SAF can be produced in an existing RD plant with a relatively simple change in kit that relies on adding a catalytic process step to crack the longer diesel molecules into shorter kerosene molecules before a final distillation step to produce on-spec products. The role of hydrogen in all these process steps cannot be understated. In many cases, availability of hydrogen should be the first thing that a project team considers.

The leading RD/SAF process technology providers are Haldor, Axens, and UOP. Operating companies such as Shell, ExxonMobil, and Neste also have in-house technologies. Although most RD/SAF plants have been built in Europe and North America, there are signs that Asia (especially China and Singapore) is increasing production capacity.

Key challenges and market forecasts

The key challenges facing the RD/SAF projects are:

- avoiding competition between biofuel feedstocks and the human/animal food chain;

- ensuring availability of hydrogen;

- maintaining the supply chain of quality feedstocks;

- reducing energy intensity of the process; and

- reducing cost of production (OPEX, CAPEX, and feedstock).

By far, the most critical challenge is lowering production costs to compete with petroleum-based fuels. Generally, RD/SAF are more than twice the price of their petroleum-based equivalents to produce, causing consumers (eg airlines) to pay significantly higher prices. Although the “green” premium is attractive to investors today, there is no guarantee that it will remain so indefinitely, and so the challenge for O&G industry is to reduce costs so that biofuels can be more affordable and are priced closer to regular petroleum products.

To manage the costs of building new RD/SAF plants, one solution is to repurpose less competitive oil refineries, which can extend their working life while saving jobs and communities, rather than closing them down. In general, RD/SAF construction projects can be categorised as follows:

- building new process plants (a greenfield site), including the logistics and storage facilities;

- repurposing existing oil refineries and fully converting to biofuels production;

- adding hydrotreating units to an existing oil refinery;

- retrofitting an existing hydrotreating unit in an oil refinery.

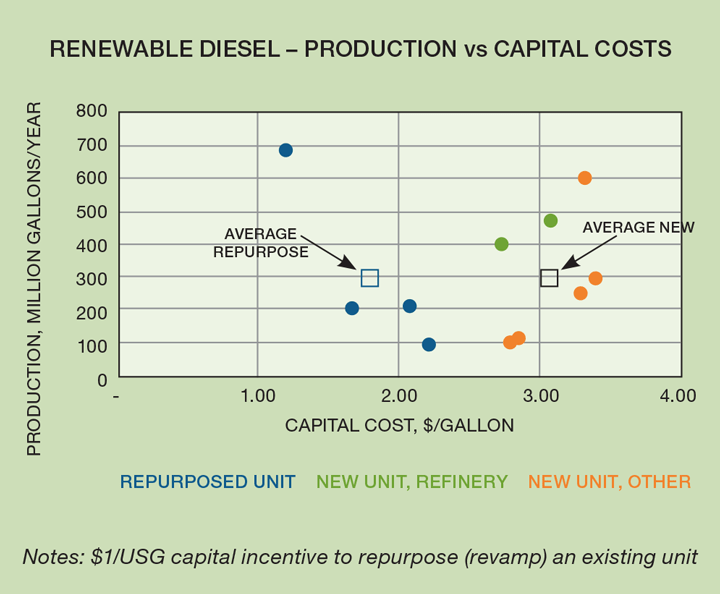

In the first two categories, the new facilities will only process renewable feedstocks. In the last two, the oil refinery continues to process crude oil with RD/SAF added to the product slate. Figure 4 displays data that has been collected from several projects in US/Canada, showing that:

- re-purposed or retrofitted units tend to cost around US$2/US gallon of RD capacity whereas new facilities could cost more than US$3/US gallon; and

- retrofitted units show gradual decline in unit costs as the size of the unit increases (economies of scale) whereas new plants don’t show a clear trend with respect to plant size, probably because the logistics, utilities, and storage facilities vary greatly between sites and impact the final project costs.

Therefore, there is a CAPEX advantage to leverage existing facilities to produce RD/SAF.

In terms of potential market size, evolving carbon reduction regulations will set the agenda for RD/SAF. For example, the EU has drafted a mandate that requires airlines to blend 2% SAF by 2025, gradually increasing to 20% by 2035. In terms of global market size, according to IEA, the total annual biofuel demand in 2021 was around 160bn L, which increased by 6% to around 170bn L in 2022. The combined global annual demand for RD and SAF is expected to increase by 15bn L from 2022 to 2027, in IEA’s “base case” scenario. In IEA’s “accelerate case” scenario, this increase could reach around 30bn L. In either case, there is huge potential for growth in the next five years, and beyond.

Conclusions

This is the O&G industry’s defining decade, as it is perceived by the public to be part of the climate change problem and must now prove that it can be part of the solution. Financial institutions are avoiding investments in carbon-intensive projects. Therefore, project developers and asset owners are tilting towards projects that are greener and easier to finance. The midstream and downstream parts of the industry have embraced energy transitions as an ‘opportunity’, developing new technologies and leveraging the existing facilities to produce biofuels. International oil companies are reshaping their image as international ‘energy’ companies with greater investments in renewable sources. The O&G industry has the expertise, infrastructure, and capital to play a constructive role in energy transitions. Chemical engineers have significant roles to play in developing and commercialising biofuels production at the lowest cost possible while at the same time helping to improve both energy security and affordability. Doing so could establish RD/SAF as the “transition fuels of choice.”

Correction: Figure 1 was published containing incorrect data related to production in 2021. This has now been corrected here and in the downloadable PDF of issue 984.

Recent Editions

Catch up on the latest news, views and jobs from The Chemical Engineer. Below are the four latest issues. View a wider selection of the archive from within the Magazine section of this site.