A Flawless Start

Demystifying the art of successful commissioning

HOW often do we hear about projects that are substantially delayed, have significantly overrun the original budget and/or have issues during startup? Often, final operation teams are provided with little or no information of the pre-commissioning and commissioning activities and any issues that occurred on the equipment during startup justified simply that, at the end, it worked and met the performance criteria.

In the 21st century, we, as a community of professional engineers, should be setting an example to the other sectors. We are involved with fairly mature technologies, developing best practices for flawless execution in startup. Yet we still have issues. This article looks at how we can set ourselves up for a successful startup, giving clients a full audit trail of everything we have done.

The need for change

Firstly, let’s look at the scale of the issue today: what proportion of projects are late? How much does that cost the industry? And how many times have we seen significant incidents during startup?

How many projects are late?

IPA Global, which maintains a large database concerning the performance of projects across the world, claims that over 60% of mega projects fail. By “fail” this means project schedule or estimated cost (CAPEX) is exceeded by 25%, and/or when the asset suffers from an inability to achieve steady state operation within a month of startup.

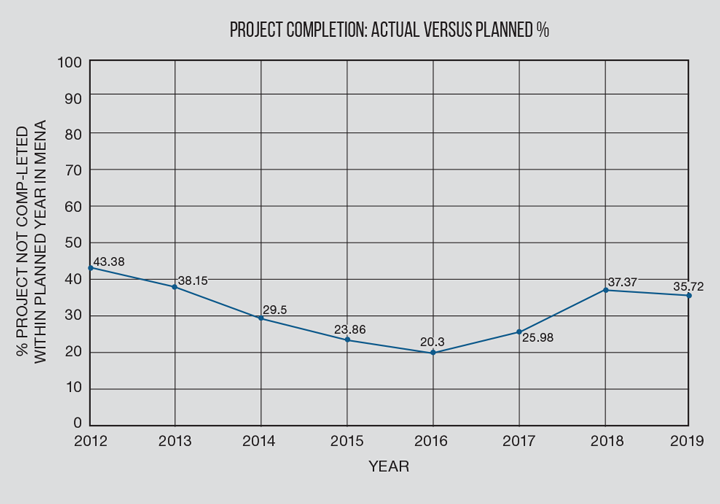

MEED is a leading Middle East and North Africa (MENA) business intelligence tool providing news, analysis and insight into regional markets, projects, tenders and government policy. Its analytics show that the percentage of actual project completion within a given year versus planned completion dates is running around 40%, meaning 60% of projects planned to be completed in MENA within 2019 will not be. This trend, as can be seen in Figure 1, has been consistent since 2012.

What’s the financial cost to business?

For projects that are not commissioned on schedule, the MEED data would suggest a recent running average project stack of US$100bn/y. Assuming that 60% of the projects run late for an average of a year and at a cost of capital of say 5%, this equates to US$3bn/y in the MENA region alone.

Are there losses of containment or damage to equipment during startup?

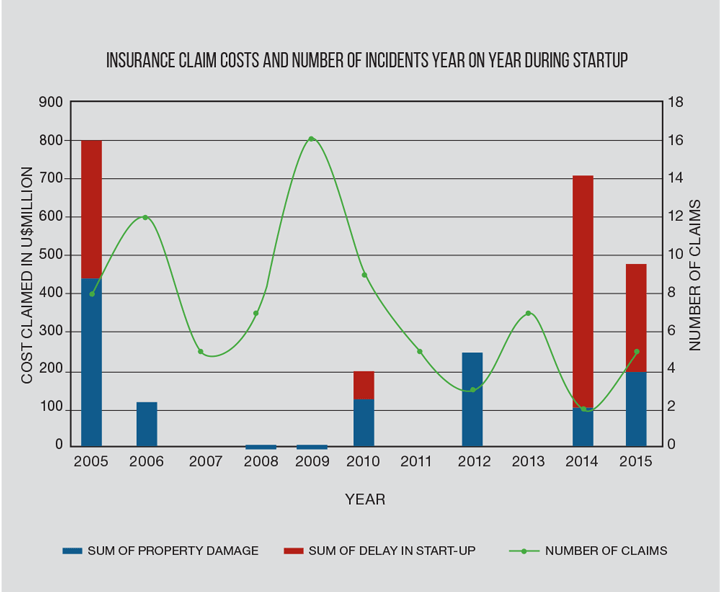

We turned to insurance and risk management company Marsh to provide data of losses that have occurred during commissioning and startup which resulted in claims to the underwriter market. Its database revealed significant losses which are a combination of the damage to property as a result of an incident and the consequential cost in lost gross profit due to the delay in startup.

Recent Editions

Catch up on the latest news, views and jobs from The Chemical Engineer. Below are the four latest issues. View a wider selection of the archive from within the Magazine section of this site.