Oil and gas majors are undermining climate goals, report warns

US$50bn invested in major projects since 2018

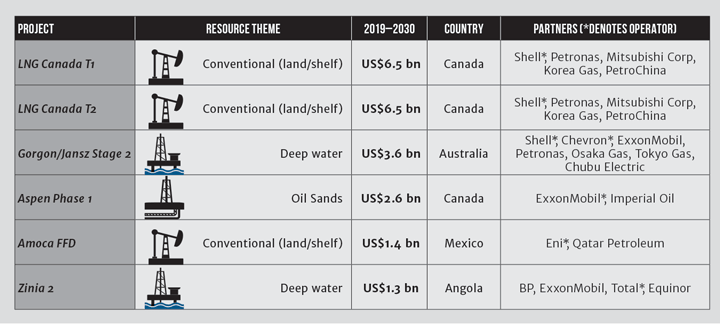

OIL and gas companies have approved US$50bn of investment since 2018 in major projects that undermine climate goals, Climate Tracker reports.

The financial think tank warns that all the oil majors are making investment decisions that contravene the Paris Agreement climate targets of keeping warming well below 2˚C, and that these decisions threaten shareholder return as they will not deliver adequate returns in a low-carbon world. Furthermore, it warns that later this year, companies will decide whether to approve another 12 inconsistent projects worth US$21bn.

Carbon Tracker used benchmark scenarios on how fossil fuel use must dramatically drop to ultimately meet net-zero emissions targets to determine which projects sanctioned last year (or set for sanction this year) fit within the limited remaining carbon budget, and which are risks to investors. Its report Breaking the Habit analysed 71 of the world’s largest oil and gas companies using project data supplied by consultancy Rystad Energy.

Majors at risk

It has found that ExxonMobil, Chevron, Shell, BP, Total, Eni, ConocoPhillips, and Equinor each spent at least 30% of their investment in 2018 on projects that are inconsistent with limiting warming to 1.6˚C. It estimates that oil companies could spend US$6.5trn by 2030 if they base their investment decisions on current emissions policies, but this will lead to 2.7˚C of warming. But as emissions policies become more stringent, the number of viable projects will be curtailed to around US$4.3trn, meaning investments worth US$2.2trn could become stranded. It advises that demand for oil can be satisfied with projects that break even at below US$40/bbl. ExxonMobil has the greatest risk of stranded assets with more than 90% of potential 2019–2030 spending outside the 1.6˚C pathway, Carbon Tracker warns. The US oil major is followed by Shell (70%), Total (67%), Chevron (60%), BP (57%), and Eni (55%).

“The eternal search for growth in the context of finite planetary limits means either the failure of climate targets, exposure of investors to stranded assets – investments that destroy value when industry dynamics change – or both,” the report reads.

Projects sanctioned last year that reportedly will not deliver adequate returns in a low-carbon world include Shell’s US$13bn LNG Canada project and BP, Total, ExxonMobil and Equinor’s Zinia 2 project in Angola. It also argues that no new oil sands projects can be Paris-compliant, yet last year

ExxonMobil sanctioned the US$2.6bn Aspen project, which is the world’s first greenfield development in five years.

“Every oil major is betting heavily against a 1.5˚C world and investing in projects that are contrary to the Paris goals. Investors should challenge companies’ spending on new fossil fuel production. The best way to both preserve shareholder value in the transition and align with climate change goals will be to focus on low-cost projects that will deliver the highest returns,” said Carbon Tracker Senior Analyst Andrew Grant.

It reports that without the deployment of CCS, sanctioned projects already exceed the demand for oil allowed under the 1.5˚C stretch target set at Paris. Compared to business as usual, capex on new oil projects should be 83% lower in a 1.6ºC scenario and 60% lower in a 1.7–1.8ºC scenario – even with significant deployment of carbon capture and storage (CCS).

A spokesperson for Shell told The Guardian: “We agree that the world is not moving fast enough to tackle climate change. As the energy system evolves, so is our business, to provide the mix of products that our customers need.”

This article is adapted from an earlier online version.

Recent Editions

Catch up on the latest news, views and jobs from The Chemical Engineer. Below are the four latest issues. View a wider selection of the archive from within the Magazine section of this site.