Taking Aim

Malcolm Wilkinson and members of IChemE’s Sustainability Special Interest Group discuss the future of the oil and gas industry

CLIMATE change is happening and appears to be accelerating. The signals are global temperature increases, rising sea levels, the reducing extent of Arctic sea ice, more frequent and severe weather events, and the growing rate of habitat destruction and species extinction. We know the increased rate of climate change results from anthropogenic emissions of carbon dioxide and other greenhouse gases. Under the auspices of the United Nations (UN), world governments agreed in Paris in 2015 to limit the global temperature increase to well below 2°C above pre-industrial levels and to pursue efforts to limit the rise to 1.5°C to avoid potentially catastrophic impacts on human existence.

More recently, the 1.5°C target has gained increasing focus. IChemE’s Sustainability Special Interest Group has prepared a series of thought pieces on how this target might be achieved and this first one looks at the potential impact on the oil and gas sector, laying out the challenges to an industry in inevitable decline.

Emissions targets

The 2018 Intergovernmental Panel on Climate Change (IPCC) special report1 on the impacts of global warming of 1.5°C above pre-industrial levels included emissions pathways to achieve this target. To achieve a 1.5°C rise with a 50% probability the remaining carbon budget is 580 GtCO2. For a 2°C rise with the same probability the carbon budget is 1,500 GtCO2. Except for a 1.2% fall in 2016, global CO2 emissions have increased annually since 2010, and in 2019 global emissions were 38 GtCO2/year2.

Continuing at this level, the available budgets would be consumed in 15 years for a 1.5°C rise, and 39 years for a 2°C rise. These emission levels are for CO2 alone, including CO2 from land use change, but do not include other GHGs, of which methane is a significant contributor. The economic downturn due to the Covid-19 pandemic has reduced 2020 CO2 emissions by about 7%, largely due to mobility restrictions, though emissions of other GHGs have been less affected. There is uncertainty on how the recovery from the pandemic will impact longer-term trends.

Except for a 1.2% fall in 2016, global CO2 emissions have increased annually since 2010 and in 2019 global emissions were 38 GtCO2/year

In summary, the IPCC emissions pathways to limit warming to below 2°C require net zero CO2 emissions by around 2050 from a peak in the 2020 to 2030 period. These emissions targets also require action on other GHGs, particularly methane, and also require the deployment of negative emissions technologies. The current levels of national emissions reduction commitments fall well short of this target, though encouragingly in 2020 some 126 countries covering 51% of global GHG emissions now have net-zero goals that are formally adopted, announced, or under consideration. It is vital that countries, in planning their recovery from the pandemic, take the opportunity to translate these commitments into strong near-term policies and actions to secure the required emission reductions.

Scenarios

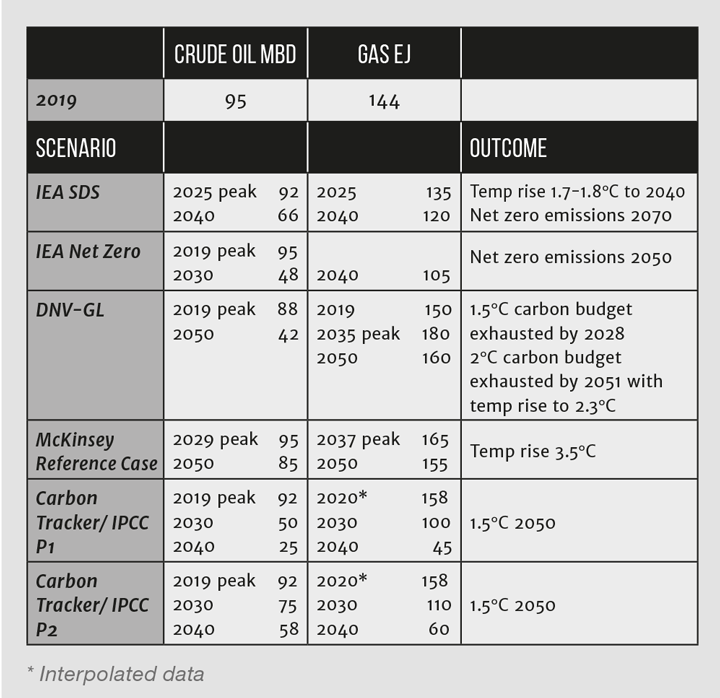

There are many potential routes to a low- or zero-carbon world, and several independent organisations have published alternative scenarios. Six are reviewed here specifically for their conclusions on oil and gas production. The IEA Net Zero by 2050 scenario3 and both Carbon Tracker scenarios4 are constructed to meet the 1.5°C temperature rise limit. The IEA Sustainable Development Scenario5 meets the UNEP sustainable development goals but not the 1.5°C target, and the DNV-GL6 and McKinsey7 scenarios are based on their analysis of trends in technology implementation. Table 1 summarises the oil and gas production rates and outcomes for each scenario.

The IEA Sustainable Development Scenario has an emissions trajectory that achieves a temperature rise in the range 1.7–1.8°C over the period to 2040 and predicts crude oil production peaking in 2025. Natural gas production also peaks around 2025. CO2 emissions do not reach zero until 2070.

The new IEA Net Zero by 2050 scenario requires CO2 emissions to fall to around 20.1 Gt/y by 2030, or 6.6 Gt/y lower than in the Sustainable Development Scenario. Low-emissions sources provide nearly 75% of global electricity generation in 2030 (up from less than 40% in 2019), and more than 50% of passenger cars sold worldwide in 2030 are electric (from 2.5% in 2019). Electrification, massive efficiency gains and behavioural changes all play roles, as does accelerated innovation across a wide range of technologies from hydrogen electrolysers to small modular nuclear reactors. Oil production falls from a peak in 2019 with subsequent production relying on continuing increase in the chemical industries’ consumption of oil as feedstock. Natural gas consumption in this scenario is about 10% lower than in the Sustainable Development Scenario.

The DNV-GL Energy Transition Outlook 2020 is based on a world energy demand of 425 EJ in 2019 and forecasts a fall in demand of 6% in 2020 due to the Covid-19 pandemic followed by a 10% growth to a peak in the mid-2030s and then a fall to 424 EJ by 2050. Fossil fuels still account for 54% of primary energy supply in 2050, while non-fossil fuels will make up 46% of the mix. Renewable energy sources are forecast to increase, driven by strong growth in solar PV (12% share in 2050) and wind (11% share in 2050). Biomass is forecast to remain relatively steady, rising from 9% today to an 11% share of energy supply in 2050. Oil demand peaks in 2019. Natural gas in this forecast becomes the world’s largest energy source with increasing LNG and hydrogen production linked with carbon capture and storage (CCS). It increases its share of primary energy supply growing from 26% in 2018 to 29% in 2050 with a peak in the mid-2030s. In this DNV-GL forecast, the 1.5°C carbon budget is exhausted in 2028 and the 2°C carbon budget is exhausted in 2051 with emissions still running at around 17 GtCO2/y. By then temperatures will have increased 2.3°C above pre-industrial levels.

The McKinsey Global Energy Perspective 2021 predicts that electricity demand grows significantly through direct electrification and the uptake of green hydrogen. Renewables quickly ramp up and account for half of power generation by 2035. Demand for oil peaks in 2029, with a 10% decline to 2050, and gas in 2037 with demand in 2050 5% higher than today. Fossil fuels continue to play a major role in the energy system by 2050, driven by growth in areas such as chemicals and aviation. CO2 emissions peak in 2023 at around 33 GtCO2 falling to 25 GtCO2 in 2050. This trajectory remains far from the 1.5°C pathway, implying a rise of 3.5°C with a 1.5°C pathway requiring an 80% reduction in carbon emissions.

Based on the IPCC’s Special Report, Carbon Tracker has analysed the impact on oil and gas production of two illustrative 1.5°C scenarios. These scenarios are labelled P1 and P2 with the main difference being P2’s greater focus on broad sustainability factors such as healthy consumption and well-managed land systems and the addition of CCS. In the P1 pathway, oil demand is satisfied by assets that are already producing or under development. Oil production peaks in 2019/20 and then declines so that by 2040 it is 3% below the capacity of currently producing assets. In the P2 pathway, the addition of CCS makes additional room for some new oil developments, but by 2040 production does not compare to the growth aspirations of most industry companies. In P1 natural gas production falls 35% by 2030 and a further 40% by 2040 whilst in P2 it falls 30% by 2030 and a further 35% by 2040.

Company responses

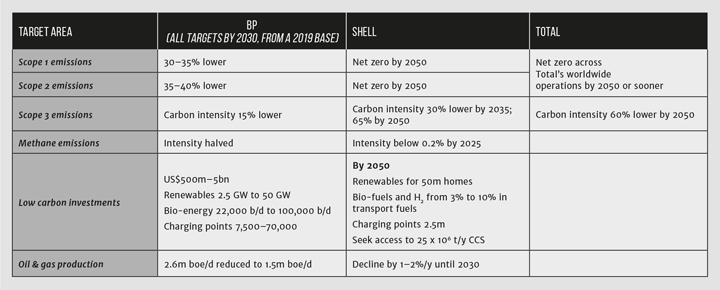

BP, Shell, Total and Repsol have all announced commitments to reach net zero emissions by 2050. Table 2 compares the approaches published by BP8, Shell9 and Total10. BP has further announced it will not explore in countries where it has no existing infrastructure, and has made commensurate staff reductions in its upstream business. BP does not include its production agreement with Rosneft in its targets (around 30% of total production). Shell only aims to reflect movement towards net-zero emissions in its operating plans and budgets at some time in the future. It also states that these plans and budgets need to be in step with the movement towards a net zero emissions economy within society and among Shell’s customers. Repsol has the strategic objective of reducing carbon intensity in scope 1, 2 & 3 emissions from a 2016 baseline by 12% by 2025; 25% by 2030; 50% by 2040; and reaching zero by 2050. ENI also plans for net zero emissions in scope 1,2 & 3 by 2050 coupled with significant reduction in hydrocarbon production. None of the US majors have followed suit. All the companies plan significant carbon off-setting to achieve their targets.

Nonetheless, a Carbon Tracker Report4 concludes that last year, all of the major oil companies sanctioned projects that fall outside a “well below 2 degrees” budget and will not deliver adequate returns in a low-carbon world. Examples include Shell’s US$13bn LNG Canada project and BP, Total, ExxonMobil and Equinor’s Zinia 2 project in Angola. The report highlighted US$50bn of recently-sanctioned projects across the oil and gas industry that fail the Paris alignment test by a margin. In 2020, leading oil and gas companies reduced the reported worth of their assets by more than US$50bn, a palpable expression of a shift in perceptions about the future. Investment in oil and gas supply has fallen by one-third compared with 201911.

Conclusions

To date, decarbonisation is not proceeding fast enough to meet the temperature rise targets set by the Paris Agreement. The scenarios illustrate that a reduction of at least 40% in oil production and 35% in gas production by 2030 is required with similar reductions thereafter, well beyond the oil companies’ published targets.

Electricity is key to the low-carbon transition. In the last ten years electricity generation has increased by 33% with 83% of this growth coming from non-OECD countries12. In 2019, renewables accounted for 10% of electricity generation equating to 41% of the growth in energy demand and were growing at 14% a year12. The motor of change rests in emerging markets, which is where all the growth in energy demand lies. Emerging markets have higher population density, more pollution, and rising energy demand. They have less fossil fuel legacy infrastructure, rising energy dependency, and are likely to seize the opportunities of the renewables age where rapid growth and technology-driven learning curves have resulted in a fall of around 20% in costs for each doubling in capacity.

The use of hydrogen as an energy vector in developed economies is gaining traction but producing it by electrolysis, assuming zero-carbon electricity, is a more efficient route rather than the oil and gas industries’ expectation to steam reform methane. The industries’ expectation of continuing 4% annual growth in chemicals with half coming from polymers also seems optimistic with the social pressures being exerted on plastic waste and the drive towards a circular economy. The renewables transition also challenges the precept that CCS will mitigate the effect of continuing to use fossil fuels for energy generation, the panacea quoted by the industry.

On the basis of the emissions trajectories to achieve less than 2°C warming, the shift to electrification of end uses and the increase in renewable energy generation led by emerging markets, the oil and gas industry faces a declining future. This, in spite of it being subsidised in 2017 to the tune of US$5.6trn as defined by the International Monetary Fund13. This is the background to Carbon Tracker’s prediction14 of a carbon bubble and stranded assets and the observed shareholder divestment in the oil and gas industry with, for example, the Norwegian Sovereign Wealth Fund announcing it was divesting its assets in oil and gas exploration.

The oil and gas industry is under pressure to provide solutions that can decarbonise the use of its products, and ultimately to transition from hydrocarbon portfolios to cleaner energy. The longer-term success of the sector will hinge on its ability to proactively drive the necessary transition rather than passively react to societal pressure. Burning fossil fuels has to stop if we are to achieve a net zero carbon world, but the unavoidable truth is that we need the resources of the oil and gas industry to help drive the transition. This has major impact on our profession and IChemE should be a driving force behind this switch to a low-carbon economy.

The recently-published and comprehensive Position on Climate Change15 details the commitments the Institution has made to promote and support this transition.

References

1. IPCC Report Global Warming of 1.5°C, October 2018, www.ipcc.ch/reports.

2. UNEP Emissions Gap Report 2020, https://bit.ly/3db3e0r.

3. IEA Achieving Net Zero Emissions by 2050, https://bit.ly/3tg8dm7.

4. Carbon Tracker, Breaking the habit – Why none of the leading oil companies are “Paris aligned”, and what they need to do to get there, September 2019, https://bit.ly/3g5iApk.

5. IEA Sustainable Development Scenario, www.iea.org/weo/weomodel/sds.

6. DNV-GL Energy Transition Outlook 2020, https://eto.dnv.com/2020/index.html.

7. McKinsey Global Energy Perspective 2021, https://mck.co/3d9T6ox.

8. BP Net Zero Strategy, https://on.bp.com/2Rjjbcn.

9. Shell, Our Climate Target, https://go.shell.com/3dU739z.

10. Total Net Zero Strategy, https://bit.ly/326kXQa.

11. IEA World Energy Outlook 2020, https://bit.ly/3dcfSMU.

12. BP Statistical Review of World Energy, June 2020, www.bp.com.

13. IMF, https://bit.ly/3g3UEm1.

14. Carbon Tracker, 2020 Vision: why you should see the fossil fuel peak coming, September 2018, https://bit.ly/3mET7nL.

15. IChemE Position on Climate Change, https://bit.ly/3wPOCeH.

Recent Editions

Catch up on the latest news, views and jobs from The Chemical Engineer. Below are the four latest issues. View a wider selection of the archive from within the Magazine section of this site.