Fast Followers: Speeding up the Global Energy Transition

David Simmonds looks at where some of the big emitters are at, and what they need to do to combat climate change

IN my last article I reasoned why Big Oil has a key role to play in our energy transition. This time, ahead of the COP27 climate conference that Egypt is hosting in November, I’ll take on the challenge that many pundits pose that whatever we do here in UK is unlikely to make a difference at the global level, as our emissions are only a fraction of the total.

Indeed, China’s emissions have long overtaken those of the US but this is on the back of a widely expanding manufacturing base, one which now supports the outsourcing of much of the Western economy. The keyboard I’m typing this on? Made in China. Or the phone you might be reading this on? It may have been designed in the US but it was most likely made in China. Even the electric version of Britain’s iconic Mini is moving its production to China. China has looked to coal to fuel its manufacturing base (or ours if you draw the operating envelope globally) and will now likely turn to Russian oil and gas as the West realigns its energy policies.

Those pundits are right that we must look at the broader picture, but as I hope to explain I believe China, in particular, is a “fast follower” of technology and will rapidly adopt and adapt energy efficient technologies to abate climate change which is already affecting the country. However, to gain a wider perspective I’ll briefly consider each of the so-called BRICS+ countries – Brazil, Russia, India, China & South Africa, plus Saudi Arabia – as they seek to expand their economies.

Personally, I have worked in a number of developing countries and have seen first-hand their desire to improve their economies and implement conventional energy technologies. Further I have conducted business with most of the BRICS and appreciate some of their constraints and opportunities. I now strongly believe that once energy transition technologies are proven, their economies will embrace them and possibly do even more with them than we can anticipate today. An example of this has been the deployment of mobile phone technologies, where several African countries adopted phone-based payments systems well before they became commonplace in Europe.

The terminology “fast follower” may be unfamiliar to some: while others develop and risk technologies, a fast follower quickly assumes the advantages of those technologies once proven.

My previous employer, BG Group, prided itself on being a fast follower. Given its size and more limited financial strength, it left the development of high-risk technologies to Big Oil. However once proven it would quickly realise the potential offered by that technology. Over time, the group’s financial muscle increased, and it could accept more risk. This allowed it to pursue more novel commercial models, such as the commoditisation of LNG to become a leader in LNG trading. Yes, some will argue that a fast follower approach is unfair, and technologies with a high IP value should be protected. However, when we consider energy transition and climate change mitigation technologies, I believe we should exploit the benefits from fast followers.

Energy demand and emissions growth across the planet

In my previous feature I drew readers’ attention to the doggedly static 80% share that fossil fuels have maintained in our energy mix over the last 50+ years. Despite energy efficiency gains, we have also seen a three-fold increase in energy demand over the same period, with a likewise three-fold increase in emissions. Nowadays almost all this growth in demand comes from the BRICS+ and other developing nations, and, as their economies grow, energy demand will continue to increase, making it harder for them to decommission older energy generation facilities. Even here in the UK as we convert to EVs and heat pumps, we will see delays to the decommissioning of gas-powered stations.

The above table, developed from the ourworldindata database, details emission increases from the BRICS+ highlighting the exceptional growth of emissions from China, India and Saudi Arabia. If you look at the wider by-country data set, the largest reported growth in emissions over the same 55-year period came from the UAE, with more than 680,000%; Oman follows with over 240,000%, while Equatorial Guinea has seen almost 35,000% growth – quite startling numbers! Along with Saudi Arabia these countries’ growth rates reflect their transition to so-called petrostates, reinforcing the need to address fossil fuel reductions.

Europe can applaud itself with a slight drop in emissions (the UK saw a 47% drop, while, interestingly, Ukraine saw a 42% drop), but as we are all aware, consumer demand is still high and as we have seen, the reduction is due to the outsourcing of energy-intensive manufacturing. Consumer demand has grown even more in the US, but again outsourcing has limited its emissions growth to just 39% over this period.

Today we can see that the BRICS+ countries contribute almost half of all global emissions while Europe and the US contribute just over 25%. Pundits look at all this data and remark as to why should Europe or the US, make sacrifices when other nations continue to grow their emissions exponentially? Let me see if I can answer that, and along the way consider one or two major risks.

Seeking a sustainable future

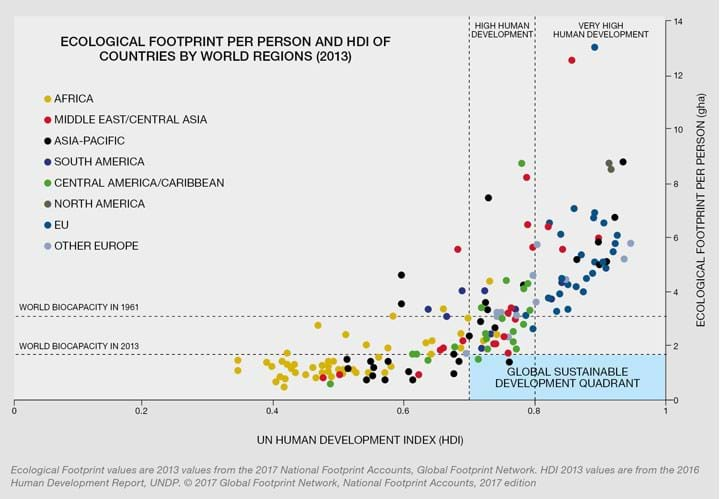

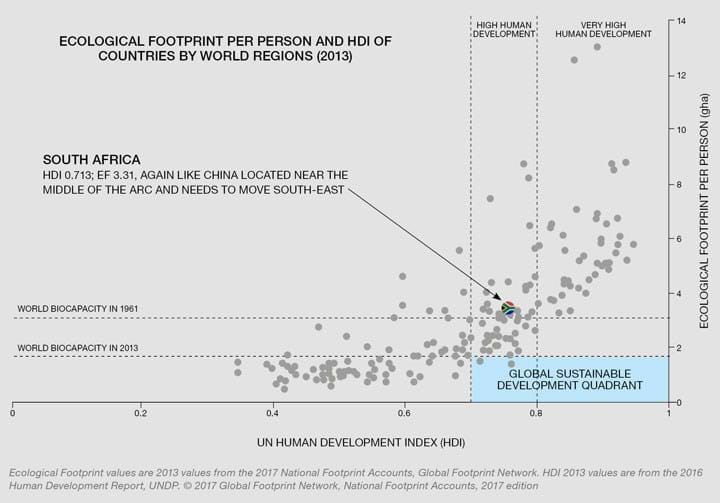

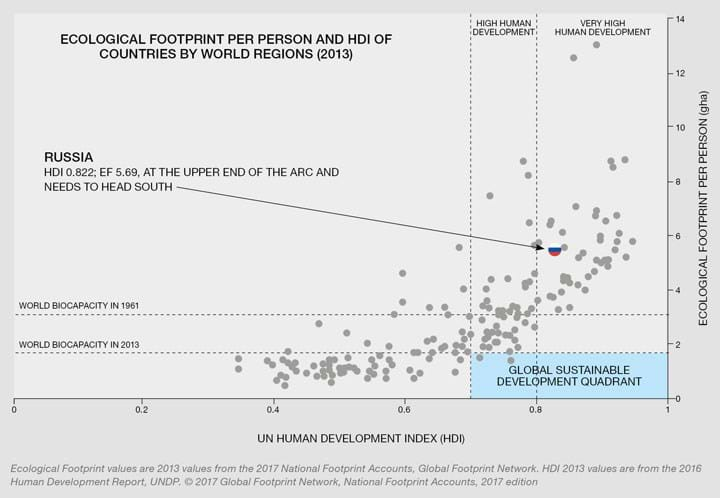

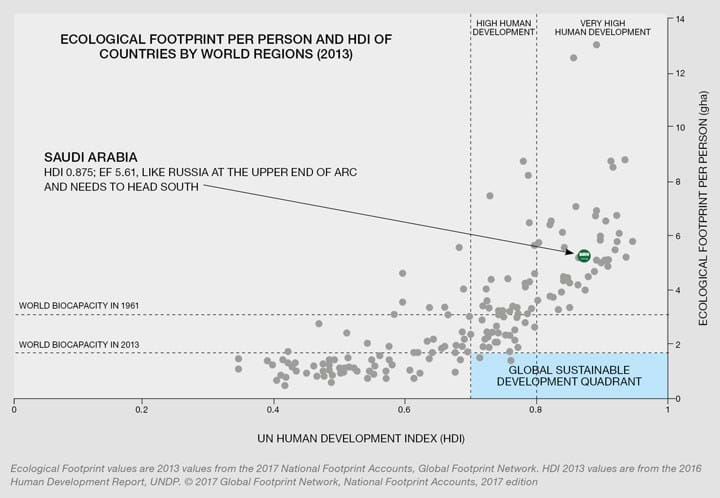

Another way of looking at the impacts can be demonstrated by considering the chart below, extracted from the Club of Rome’s “Come On!”. This chart, prepared by the Global Footprint Network, positions countries by their level of human development (HDI; index range 0–1) and their ecological footprint (EF, hectares per person); the latter equating to an average energy/emission footprint. It also shows an ideal or sustainable development quadrant, and, as can be seen, only a couple of countries are currently positioned there.

With current technologies, economic development typically tracks a path towards increasing energy demand, and some of the BRICS+ and many other countries are rapidly moving up the “arc” (north-east) and not towards that sustainable quadrant. So, to tackle climate change, we need to:

- reduce demand and increase efficiencies in developed economies (ie those within the “very high” human development cohort) moving their dots south; and

- increase the human development index sustainably for the developing country cohort, moving their dots due east rather than northeast!

When one considers this chart and the position of the different nations, one can quickly grasp that we need a range of strategic initiatives; one size does not fit all.

Fortunately, we have a range of potential technologies which can mitigate climate change, capable of delivering sustainable solutions for both developed and developing nations. These are either being implemented, being tested, or being considered, and it is not the purpose of this article to detail these here though I will refer to some. The short-term challenge is to demonstrate the viability and benefits of these technologies, and once proven, many nations will be able to adopt them directly to facilitate sustainable and economic growth.

Step-changing the transition across the BRICS+

Given that the BRICS+ countries are accountable for almost half of global emissions, let’s briefly look at each in turn to see how they are responding or might respond in the future. I will start with China and India, for as we have already seen from the statistics, they are the most significant players in the process.

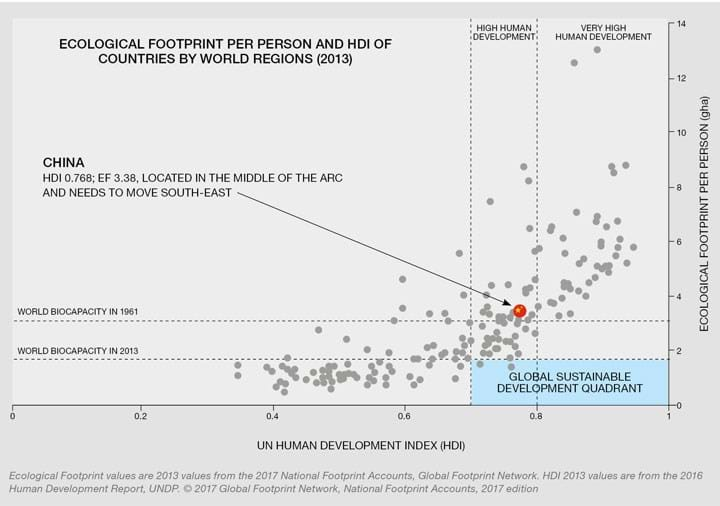

China

As the pre-eminent manufacturing nation on the planet, China is now the most significant emitter of carbon, accounting for more than 25% of all global emissions. Over recent years it has tried to move away from coal to natural gas, but shortages of gas, a ready availability of low-cost domestic coal, and its high growth rates makes this a challenge. China well recognises the impact of emissions on the planet and is directly experiencing the consequences of global warming, so I believe it will adopt new technologies if these can be delivered quickly and at low cost. I have personally witnessed China operating as a fast follower for deployment of fossil fuel technologies, and it has grown skills and capacity to participate widely in that sector. Its technological, financial and skills base is such that it is more than capable of widely deploying transition technologies once they are proven.

Indeed, following development elsewhere, China is already the world leader in battery, solar, and electric vehicle production. It is also looking to cut the costs of electrolysers for hydrogen production. China is already playing its part in the global energy transition; it sees the business opportunity! I believe it will continue to be a fast follower for other renewable energy supply and use technologies such as wind turbines and heat pumps. A key issue for the rest of world though, is whether the country’s production of these products is being accomplished in an environmentally sound way.

China’s car ownership cohort is also growing very quickly, but expectations on performance and range are different. The West’s solution for EVs is glossy high-spec models, while many Chinese buyers are happy with a basic vehicle which can achieve say 100 km on a single charge. This trajectory is an example of how a nation can move easterly, towards that sustainable high development, low footprint quadrant. I believe over time, widespread deployment of heat pumps powered by solar energy will provide another example of sustainable “easterly” growth.

That said, moving away from today’s fossil fuels consumption is the major challenge, for, as we have seen, China is so dependent upon them for its manufacturing base. However, I believe it would be willing to adopt effective carbon capture and blue hydrogen technologies once these are proven and routinely deployed. Rapid replacement of China’s energy resources is just not feasible, and that is why its plans look for a longer transition than other countries, carbon neutrality by 2060. Yes, we might seek a rapid penetration of green hydrogen technologies here in the West, a solution to move us south on that Come On! chart, but I believe we must also demonstrate the effectiveness of carbon capture and blue hydrogen so that China and others can become fast followers to underpin the transition for its large manufacturing base. Sinopec has already completed China’s first CCS project, while, building on my prior piece, major Western companies, such as Dow, Air Products and Baker Hughes, are looking to help China deploy green technologies.

China needs to continue to be a fast follower. However, current geopolitical challenges are likely to inhibit the process and provide significant risk to the delivery of the global climate change programme; our fingers need to remain crossed!

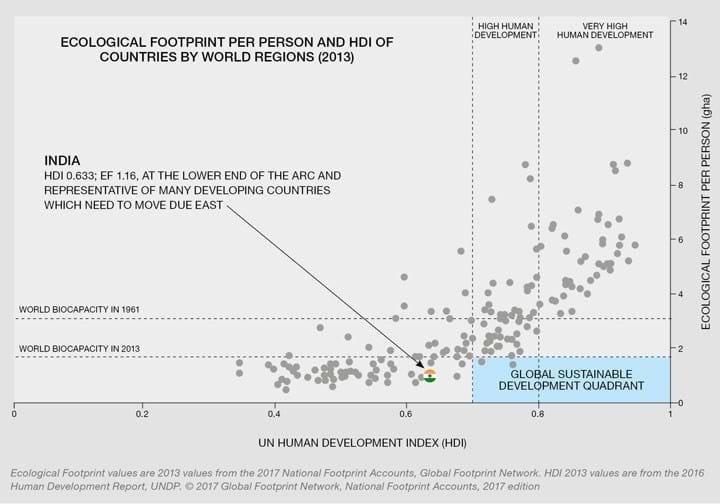

India

India’s emission growth rate is not far behind China’s. Positioned lower down on the Come On! north easterly arc this is driven less by exports, than by sheer growth of the country’s population and increasing living standards. However, there are many similarities to China; in particular, the capacity of its workforce to deliver technological solutions. I have seen this first hand with BG Group’s India asset team rapidly skilling up. More widely we see India successfully operating as a fast follower in the IT sector with its own Silicon Valley.

Like China, the Indian Government fully acknowledges the challenges and concerns related to climate change as it looks to the impact on its own and neighbouring economies. It too has declared carbon neutral targets, though, again with a longer timeline, looking for carbon neutrality by 2070.

The National Geographic recently provided a good review of India’s energy strategy and climate change initiatives. Briefly, this includes the creation of 45 solar parks; a plan to have 40% of buses, 30% of private cars, and 80% of two- and three-wheelers go electric by 2030; and a mission to become a global leader in the production of hydrogen as an alternative to fossil fuels. However, today the country is dependent upon domestic coal, and it requires cheap alternative energy solutions. Once the costs of renewables and other green technologies become competitive, take-up will be very fast. I believe India will look to China, rather than the West, for this impetus, for as we have seen, China – through its capacity to scale up technologies – can significantly reduce the cost of kit, such as solar panels, to meet India’s demand.

Hopefully India will build its own capacity for climate change remediation, though this is likely to be as a “second step” follower once costs come down.

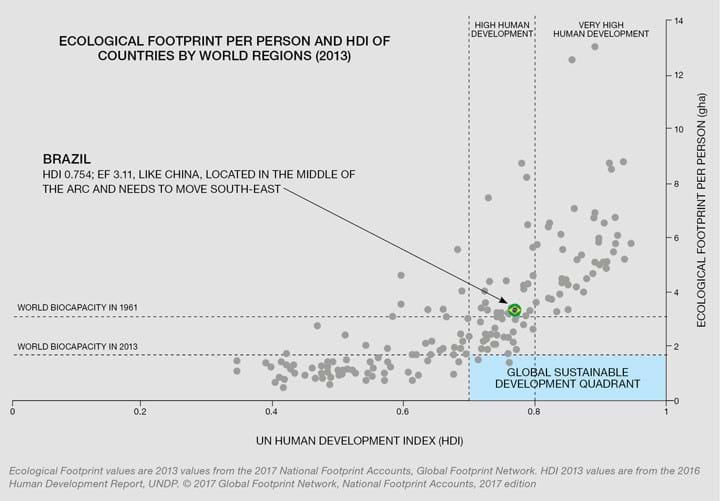

Brazil

Brazil is a leading petro-economy, and so its route for transition will be very different from India and China as it looks for replacement of revenue. Carbon capture and storage will be key technologies for Brazil as it lowers emissions from fossil fuel production. Furthermore, Brazil can look to these technologies to help customers reduce their emissions. Again, Brazil has the skilled workforce to deliver this once the technologies are commonplace.

Brazil is also well placed to capitalise on offshore wind. Renewable energy will “green up” its own energy supplies, but longer-term Brazil could become an exporter of green hydrogen. As quoted by one Brazilian business development executive: “We are extremely well positioned, not only with existing infrastructure, but also because part of the supply chain that attends the oil and gas sector will also serve the offshore wind industry. There are a lot of synergies and competences to be captured.”

Another key concern for Brazil and indeed the rest of us on the planet is the destruction of the Amazon rainforest. Brazil is starting to recognise the impact this is having on the climate, and so my hope is that, with its significantly higher revenues post-Ukraine, fossil fuel producers will increase their social support funding towards enhancing the lives of those who live in the Amazon region. Personally, I helped identify a broader regional jobs programme in Tanzania when it was looking at a major gas project, and I believe a similar approach could be applied more widely across Brazil to enhance livelihoods to avoid the need to cut down trees!

Brazil has the capacity and potential to be a fast follower, but, as recently demonstrated, political pressures may inhibit the takeup of climate change measures.

South Africa

Earlier this year IRENA compiled a renewable energy market analysis for the African continent which concluded that it is lagging in the transition. However, it went on to highlight the game-changing potential it offers for both energy and jobs. Yes, South Africa, and, having worked many years across Africa, I can see more widely that Africa as a whole, has most to gain from renewables and other green technologies.

Today, the majority of South Africa’s power is generated from domestic coal, though it depends upon high-cost imported fossil fuels for transport and industry. Along with Nigeria and Egypt, South Africa leads the continent’s manufacturing base, and in the first instance they each need to become fast followers of renewable technologies. Like India, they also need the cost of renewables to drop to provide the economic stimulus for the transition. Once this happens South Africa can become a technology leader for the continent!

Solar offers the greatest potential, and nearby Namibia is already being slated for major solar developments to produce green hydrogen or ammonia for export to Europe. In the first instance South Africa needs to replace its own energy requirements and has a 2030 renewables goal of 19 GW, but perhaps it too has the potential to become a future energy exporter! Pioneer projects are needed for South Africa to deliver this potential, but these will only come once the technologies are firmly established elsewhere.

South Africa may be a little behind than Brazil in capacity to implement climate change measures, but I believe there is more political goodwill for it to be a fast follower.

Russia

The last of the five BRICS countries provides the greatest challenge today for obvious reasons. Like Brazil it is a petro-economy, but so far has not been ravaged by climate change. Of course, global warming could have more serious consequences for the Russian Tundra, but methane releases from this area will have more global than local impact. Climate Action Tracker (CAT) notes: “Russia’s lack of any substantial contribution to international climate finance goals, together with its highly insufficient domestic target and climate policies, result in the CAT giving Russia an overall rating of ‘critically insufficient’.”

That said, the current energy crisis will accelerate the growth of green technologies and energy universally, and longer term, Russia will lose its leading position as an energy supplier if it does not turn to renewables. The physical size of the country and its expertise in handling gas means that it too has the potential to become a major hydrogen or ammonia exporter.

Today Russia appears to have little appetite for implementing climate change measures, so, at best, I anticipate it being a slow follower.

Saudi Arabia

I have added Saudi Arabia to this review as it is clearly a very influential player in today’s energy scene, and potentially it too has much to lose from the transition. Saudi is vulnerable to the impacts of climate change, including increasing risk to its water security, through decrease in frequency and amount of precipitation, and to increasing temperatures. As one of the wealthiest nations on the planet, Saudi Arabia has the potential to become a demonstrator of new technologies as it can afford to take risks. Indeed, it is leading with carbon neutral mega-city projects like Neom, being built on the Arabian Gulf coast.

In the short- to medium-term, Saudi Arabia needs to protect its revenue stream from fossil fuels and so it is looking to carbon capture and storage opportunities and is using its wealth to establish a state fund to promote blue hydrogen and CCS projects. Further, Saudi Arabia can promote green hydrogen production, matching some of neighbouring Egypt’s ambitions which will be tabled at COP27. Yes, the Arabian Gulf has the potential to benefit from renewables as it can becomes a regional solar energy centre of excellence. After powering domestic consumption, the region will look to export green energy.

In order to promote its position globally, I can envisage Saudi Arabia accelerating its climate change programme and to become a very fast follower.

Proving technologies for fast followers

This whirlwind tour of the BRICS+ countries hopefully demonstrates that there will be significant inertia for renewables and other green technologies once they are established. For India and China there are direct links to the impact and costs of climate change, but ultimately fast followers will only adopt proven and economic technologies, as they come down to cost. Many technologies are available, but they need scale and commitment to drive down cost. The recent DNV Energy Transition Outlook, which primarily looks at the developed nations, notes that we have what we need, both in terms of technology and maturity, but that Governments need to be bolder and pursue execution opportunities.

As we have seen, every nation needs to adopt its own unique path, and so I would argue strongly that developed democracies need to be bold in pursuing and promoting the whole range of technologies so that others can follow their own optimal path. I stress whole range, for ultimately to crack that 80% dependency on fossil fuels in the timescale needed, we require multiple sets of technologies which I rank as follows:

- First, renewables, directly powering our economies through high efficiency

- Second, the use of renewables to generate green hydrogen and in turn ammonia which can be transported, stored, and used for peak-shaving; yes, they offer flexibility

- Third, transition technologies to utilise fossil fuels responsibly through carbon capture and storage to ensure continuity through the transition.

In a YouTube presentation I described these as gold, silver, and bronze technologies. Ultimately, we will require just the gold and silver, but as we have seen through our tour of the BRICS+ countries most, particularly China and the petro-states, will also require the bronze “transition” technologies. In my presentation I also referred to the need to promote energy efficiency measures which are essential universally.

My brief review of China revealed concerns over the impact of the transition itself on climate change and geopolitics. A rush to gold technologies, EVs, solar panels, wind turbines, and heat pumps requires massive investment in resources and associated energy consumption. If China continues to be the main source of this investment, its own energy transition will be more challenging, exacerbating the crisis. Our continued dependency on China for its “kit” may also further complicate today’s geopolitical challenges. Perhaps we should bet a little more on investment in India to spread that risk?

I believe we need a more considered approach towards gold and silver, using lower exposure bronze technologies to get us to our longer-term goal. Indeed, even here in the UK, fast-tracking the transition to high-spec EVs could lead to more waste if the optimal longer-term solution were to be hydrogen hybrid vehicles! Locking up seabed space with today’s windfarm technology may preclude deployment of more efficient long-term technologies.

A fast follower does not exist without an execution phase leader, so we need bold leaders, even possibly loss-leaders, for each set of technologies to demonstrate their viability and economic benefit. Once this has happened most of the BRICS+ countries and ultimately the rest of the world will become fast followers towards our global energy transition; that 80% is an enormous nut for COP27 to crack without leaders! Governments need to set effective policy, while Big Oil, with its higher revenues from today’s fossil fuels, needs to accept more development risk from future energy to recreate its future, and stimulate those fast followers.

Recent Editions

Catch up on the latest news, views and jobs from The Chemical Engineer. Below are the four latest issues. View a wider selection of the archive from within the Magazine section of this site.