Cutting Through the Noise of Green Hydrogen Projects

Alex Howard and Jonathan Upton offer criteria for determining which projects are likely to succeed

How do we know which ‘green hydrogen’ mega project announcements we see, hear, or read about are likely to come to fruition, and which ones are likely to go the same direction as the other 90%?

According to the Hydrogen Council’s September 2022 Hydrogen Insights report there are 680 large-scale project proposals worth US$240bn that have been put forward, but only about 10% (US$22bn) have reached final investment decision (FID). Why is that?

This article will identify what is current and real, and which technologies and scale of projects are still in development for future potential growth areas.

Why are so many green hydrogen projects being proposed?

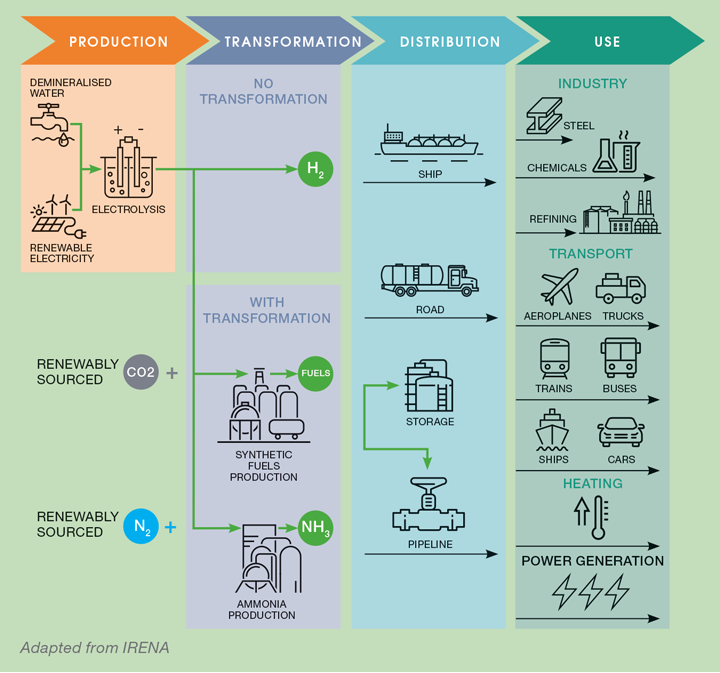

All major energy companies are keen to demonstrate that their environmental, social and governance (ESG) strategy aligns with their project investment portfolio, as well as with their decarbonisation goals. There is huge potential for hydrogen to be used in almost all major industrial sectors. As shown in Figure 1, adapted from the International Renewable Energy Agency (IRENA), hydrogen has the potential to support multiple sectors that are challenging to decarbonise.

All “green hydrogen” projects of any significant scale are referring to hydrogen produced by an electrolyser powered using a renewable power source. The electrolysis of water is not a new technology by any means, having been performed by William Nicholson and Antony Carlisle in 1800. The first commercial alkaline water electrolyser (AWE) units were in operation as early as 1890 for French military airships. With over 140 years of commercial operation, what then are the areas of development?

In truth, the bulk of electrolyser operating history has been achieved with smaller scale units and for applications where there is no alternative viable hydrogen (or oxygen) source. The use of electrolysers in submarines, and the International Space Station demonstrate this well. Commercially it has not been economically viable to have large scale electrolysis facilities for hydrogen production when the reforming of natural gas is a considerably lower cost alternative.

Technology readiness level (TRL) & scale up

It is worth noting that the wealth of electrolyser design and operating history, despite being at comparatively smaller scales to those of interest in today’s climate, leaves us in the excellent position of having electrolysers that work at relatively high efficiencies, above 90%. Practically, this means that the electrolyser manufacturers can focus their efforts on scale-up, without the distraction of also needing to make efficiency improvements. While there are certainly efficiency improvements that can and we are sure will be made, there is comparatively little scope to do so. Ultimately this means the costs of manufacture, operation and maintenance are the only aspects where impactful gains can be made by the electrolyser suppliers to support a successful outcome at FID.

Electrolyser technologies

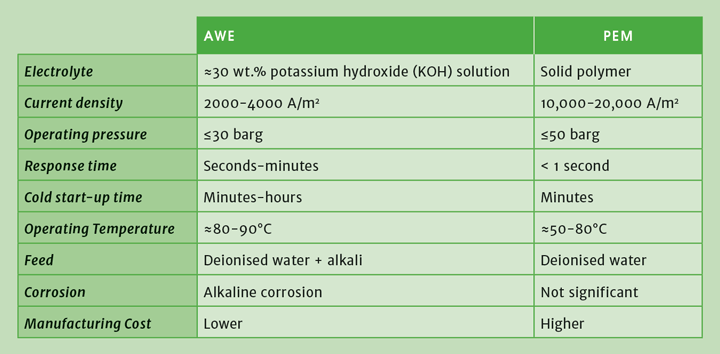

While electrolysis of water for hydrogen production has been successfully performed for many years, the majority of that operating experience has been with AWEs. In more recent years, proton exchange membrane (PEM) electrolysers have gained more attention. PEM units are commonly found in current commercial operations due to their higher suitability for certain applications. Other more novel electrolyser technologies are getting attention in the research and development setting, but are not yet sufficiently developed for current or near-term commercial green hydrogen projects. Both AWE and PEM technologies are considered mature and are considered viable for new green hydrogen projects. What’s the difference between the two competing technologies then, you might ask? While it’s possible to detail the differences between the two technologies at great technical depth, the differences are best explained based on their impact to real-world applications that projects must consider during their technology screening evaluations, shown in Table 1.

Recent Editions

Catch up on the latest news, views and jobs from The Chemical Engineer. Below are the four latest issues. View a wider selection of the archive from within the Magazine section of this site.